Good morning. Happy Friday.

The Asian/Pacific markets closed down across the board. Hong Kong, South Korea and Taiwan dropped more than 1%. Europe is currently mostly down. Austria is up 1%. France is down 1% and Greece is down 3.3%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up slightly. Oil and copper are down. Gold and silver are down.

Yesterday after the close JP Morgan announced a $2 billion trading loss. The S&P futures immediately dropped about 12 points (right now they’re down 6.5). Why would the market sell off when JPM’s trading division loses money? JPM is half bank and half hedge fund. If the bank part does well/poorly it implies something about the economy. But if their gamblers place big bets and lose, who cares? It implies nothing. It doesn’t mean the economy is doing better or worse or anything. It just means they placed big bets and were wrong. There are 1000’s of hedge funds out there, and we never know how any are doing…and we don’t really care either. But since JPM happens to also be a bank (and is publicly traded), we get regular reports. I still don’t think it matters…other than the fact that it’s obvious the idiots didn’t learn anything from the financial crisis.

Heading into today, the Dow is down 1.4% for the week, the S&P and Nas about 0.8%, and the Russell is flat. Considering the news in Europe, these losses aren’t bad. A good up day would have put the market’s weekly performance in the “pretty good” category. It’s still possible, but with the opening gap down, it’ll be much harder.

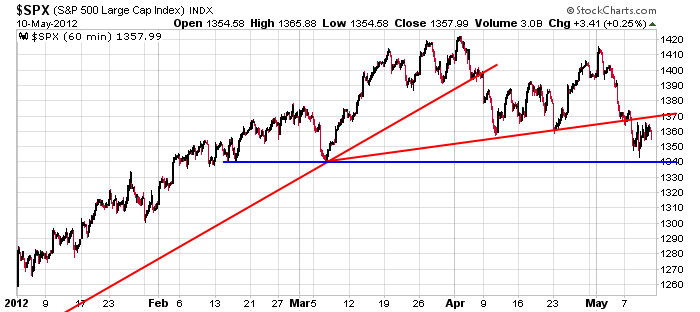

Here’s the 60-min S&P chart. Over the next day or so support is at 1340 and resistance at 1370.

On an intermediate term basis, the path of least resistance is down. On a short term basis the market may be getting close to being overextended to the downside. We’ve had lots of good shorts the last couple weeks. The risk/reward for entering new shorts is not great at these levels. Patience is needed. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 11)”

Leave a Reply

You must be logged in to post a comment.

Hi Jason,

regarding jp, I think it highlights the fact US banking is tied to europe. It makes people wonder how correlated this may be.

If financials can’t lead, the very day after csco makes people ask if tech can lead, causes pause. as it should

It’s possible. I don’t know why they lost. If they were betting Europe would right itself, they yes, their losses are a function of Europe’s decline. But if their losses are due to taking leveraged bets in other areas and just being wrong, there’s no correlation.

this is way out there, but do you remember the old story of how the original person J P Morgan

used his bank to help the US government? long long time ago. we can file that under things that make you go hmmm

bought some arch coal at 8.17. Another round trip would be great. Huge short intrest and traders are flighty. good movement good trader

ps little peter wants to know if he can not read my posts they hurt his feelings

bought some more ACI at 8.02. I’m trading it in my IRA. I won’t mind holding it

sold some for 2% in 5 min. thats fast money

damn I just remembered… I forgot to check and see if there were some waves to analyze

Russ, you mean you forgot to check the ever so correct elliot waves, fibs, and with Cramer before making your fast money.

Lean from Russ everyone – elliot waves, fibs, ects are not needed to make money. Think for yourselves.

cramers a moron. its called mad money. should be called cnbc clown show

there are 2 ways to be productive. read and learn or teach

my email address is b.mcmurry@comcast.net

are you one of the three stoogies?

yes. I remember now. ernie

shorts leaning I hope they don’t give up. we’ll see how bad the fed wants flat

I think the writings on the wall. damn. we’re oversold. maybe something hopeful will happen and we can go up

Like some others who have found it unproductive to spend their time posting comments on this website, it’s time for me to move along.

I’d like to express my sincere best wishes to everyone for continued success in their trading and, most of all, to Jason for providing this forum to share trading ideas.

my email is chrisgo47@gmail.com

after saul saw stephen stoned he realized he had scales on his eyes and was blind. he was told to go and be taught, but you can’t teach a pig to sing. it just wastes your time and annoys ths pig

e wave is one of many tools. you can use it when its appropriate and it works, but you cant always use a saw to tighten nuts.

on one side are indicators for ta and there are dozens. on the other is fa.

you cant always saw everything without looking around

e wave is a % system of fibonacci named after himself by a french man who stole the idea from greeks and indians at least 2500 yrs ago. Its really called the golden ratio or golden rectangle. Its found throughout the universe. seashells, whirlpools even the spiral of the galaxy. the pyramids were built on the ratio and divinci used it in art. its basically a rectangle minus a square repeatadly then drawing a spiral through the apexes. the sequence of numbers is phi 12358. you just add the last 2 numbers for the next one. its also the fib retracement numbers. its amazing to find it in the market, but it doesn’t always happen. esecially when the markets being managed on some other agenda

russ u have ur history all wrong–the pyramids were built by little snake like creatures

that inhabited carbon hydrogen engines called bodies–these snake like creatures called goulds

came from mars in triangluar spaceships in wave 4 sometimes also wave 2

now on mars was a report back in implant station where earthlings would go after they droped their bodies and it was a thought control station for earth

now back in 1130 bc i led the knights of the white horse–romans/chinesse arab against the eygptian brotherhood of the snake–we had spaceships as well and we put a end to the eygtian brotherhood of the snake – the goulds were defeated in waves 1 3 and 5 impulsive advances and the marian implant station closed down

dont u watch t.v or know modern history

look at you own usd one dollar bill and you can see the trianglar spaceship and the eye in the spaceship is a marsian gould

…but the snake was resurrected and we were saved

INTC being propped hard. double the bang for the buck, both nas and dow

europe closed up above y/days high –maybe the ecb /fed will give us a wave 5 impulsive mind set or maybe its just a implanted delusion

my bet is its the instos–the only ones that move the market having just distributed and getting enough puts and shorts in are now getting ready for next weeks monthly opts ex

thats the only real game in town

of course apart from morgans sqandering good fed easy money liquidity and ofcourse its counter party risks

when the banks are treated like good retail traders and have to pay their margin calls and show their losses will be the day

the nanke figured out raising margin on commodities to thwart inflation. it must be good to be the king

my tick indicator is registering massive negative extremes ind the bigboys are selling this up like crazy

or is it short cover

I could imagine frustrated short covering going into a weekend

well price is now under my 20ema and 12 simple ma on all indexes so i have taken the scalp just below y/day high piviot exit will be the main piviot or before

sounds like a good spot, but remember only savy sharks are left in the pool and they see everything you see. you know it’s the gap that kills

well geting bored and tired

sp and dow cash and futures hit main piviots–ndx strongest

all may bounce from here /or fall

if im awake for the close i might reevaluate then

gotta hit the elliptical. my reward will be margaritas and nascar. later

euro still looking sick

its the speedos