Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. There were no big winners or losers. Europe is currently mostly up. Greece is up almost 3%, and Belgium and the Czech Republic are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down slightly. Oil is flat, copper is up. Gold is up, silver down.

The market has had a rough time lately. The S&P has dropped 5 of 6 days, and the one up day was a very small gain. We’ve had many good short set ups and no good longs. The downside has been the way to go, and although I think the path of least resistance is down, let’s not get overly bearish in the near term. The bears have had plenty of opportunity to completely take control, but they haven’t done it so far. Each day this week the bulls have pushed prices up intraday.

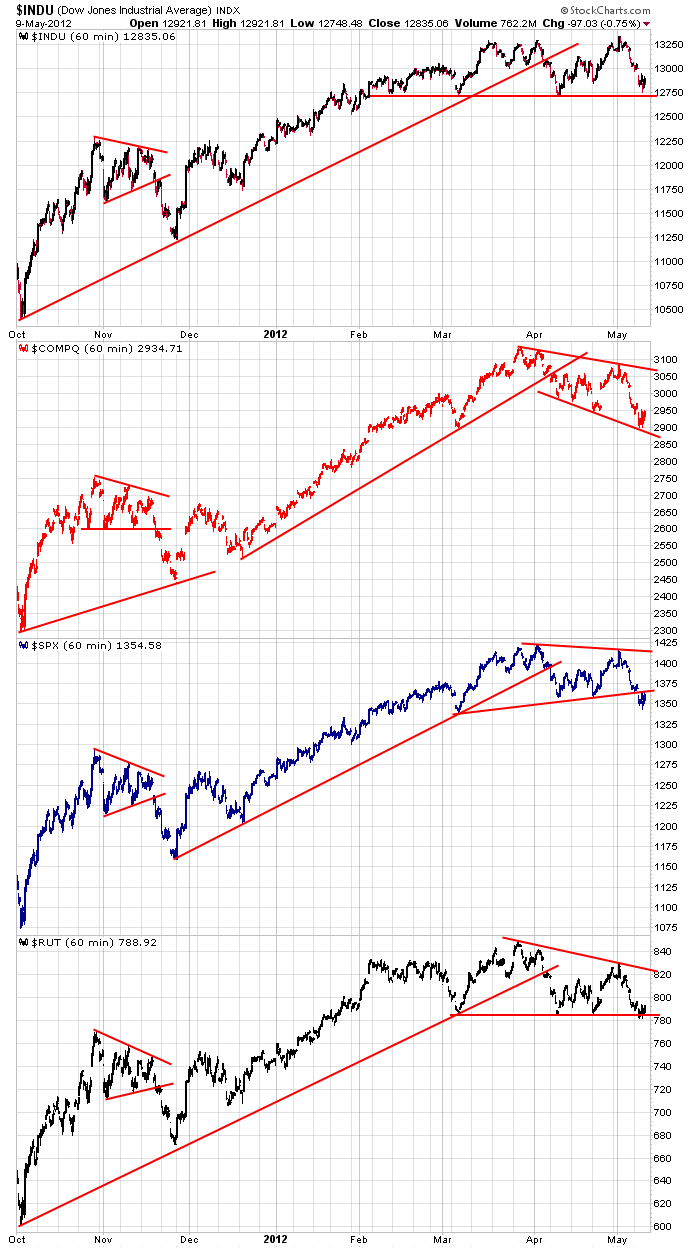

Here are the 60-min charts. At the risk of sounding bullish, these charts are salvagable. Allowing for a little wiggle room, the Dow, S&P and Russell could still be considered in large consolidation patterns. The Nas is in a falling, broadening wedge pattern, which considering the rally that preceded it, isn’t overly bearish.

The easy money on the downside has been made…it’s not wise to chase stocks down. The market could have collapsed this week, but it hasn’t so far. A little good news or a lack of bad news could induce a short squeeze. Be on the lookout. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 10)”

Leave a Reply

You must be logged in to post a comment.

they let us have our may selloff without disturbing the closing levels for 401 nervous nellies. back to the prop. got to hand it to em, they’re playing it like a violin

Hey Brian – I have to view the 1t hr as completion of wave 4 “flat”. I’m short at SPX 1362.

Looks like whiplash. I’m sitting on the sidelines for now.

yeah whew really being whipped around. time to go suk on a cork and look for a wave. wonder whats going on. anybody have a clue?

1st hr

A blind sewer rat can’t avoid having tunnel vision, but what it finds is not a piece of cheese

I’m primarily focused on non-directional trades. The last three months have been great. I hope this holds out until next Friday 5/18.

Non-directional trading is working for me. I don’t have to concern myself with elliot waves, fibs, etc. I keep it simple with basic support and resistance lines as drawn in the above charts.

I don’t make the big money like you folks do in directional trades; however, when your out of the market I’m in it. The chop is my slop and I love it.

I do have 2 directional trades on (very small).

JASO – long

WGO – short

Brian – I’m putting a breakeven stop on my short position. Even though the price action on SPX is in a tight range, the failure to move down through the 1353-55 area so far after an apparent double top at 1366 may be significant. The move up from yesterday’s low appears to be corrective and the move down today seems corrective as well, IMO. If this continues, it leaves open the idea that yesterday’s low may have completed a 5 wave donward structure from 1415 and we may be headed higher to test 1370-90. It also implies, IMO, that wave C topped at either 1422 or 1415 & the rally since yesterday is wave 2 (of some degree) of the beginning of a larger bear move down.

One last thing. I’m getting a bit tired of the ignorant comments from Russ. I’ve always found that it’s a waste of time to reply to such ignorance so it may be time for me to discontinue commenting. You (and Chris) seem to have some interest in discussing EW as a TA tool. If you know how we can contact Jason to permit an exchange of email addresses, I’m OK with continuing our dialogue. That way, Russ can have the site all to himself to enlighten viewers on his market manipulation theories.

tolerance of all things ,Pete

whilst all my indicators are based on short term intraday insto moves,i presume similar to Russ’s–i find ur EW very valuable in longer term perspective and imo it would be ashame to see u stop posting

now as to short term intraday moves

i find it now not to be a battle between the bulls/bears,but now also the sideways roosters

To be clear, I have no problem with respectful disagreement or being good naturedly chided for things like my verbosity (as an example). But I have no tolerance for mean spirited, foul mouthed comments from whatever source. I thought we had our fill of that garbage on this site with Neal. Unfortunately, it only takes one person, hidden by anonymity, to make things disagreeable. Jason gives everyone the opportunity to comment on this site and I believe it shows a lack of respect to him and everyone else who views this site to comment in an inappropriate manner. But, maybe I’m just showing a difference in age and the generation I belong to.

oh poor baby

yes russ i object to ur comments to–ur sarcasum is not welcome

I object to ur stupidity

further may i add that these are highly controled insto markets and imo the down could simply be correcting and setting up for next weeks opts ex

but sooner or later the fundamentals of europe/usa will cause a crash –in EW terms i think u call it social economic factors and the all the one market principal of EW i can attest to as correct as i view the world intra day on the 1-5 min charts,inc currencies ect

We have a winner – the money is in options. Options experiation is next week. Learn about options and then you will be enlightended.