Good morning. Happy Tuesday.

Yesterday the market dropped a bunch. The charts posted in yesterday’s Before the Open broke down, but as I stated over the weekend, that doesn’t necessarily mean the market is going to completely fall apart. It may need to rest, and perhaps it will continue up at a slower rate (shallower trendline). Or of course a top could be in place. Some internals suggest we are closer to a tradable top than bottom – or at the very least some overbought readings still need to be worked off before the next leg up can begin. Here are some of those internals.

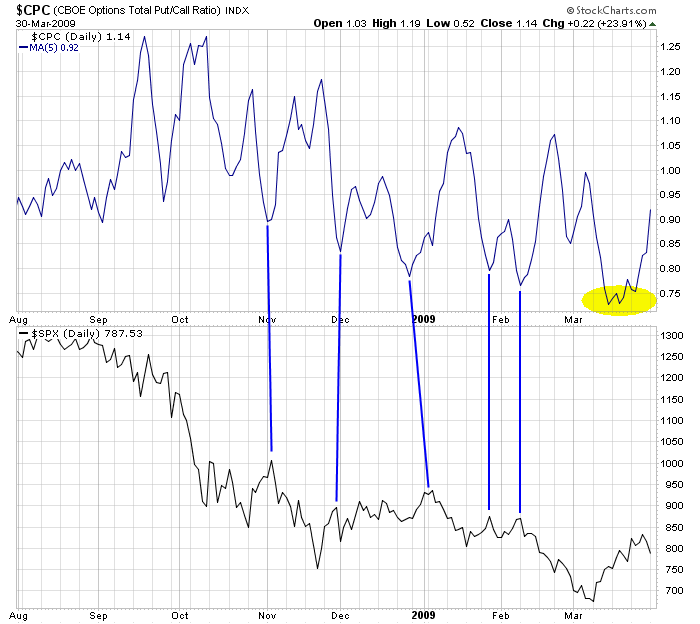

The Put/Call hovered in the 0.70 – 0.75 area. It would have been unlikely to rally from that level, and as of now, more time is needed for it to rally and top out (i.e. we need more fear before the market can rally again).

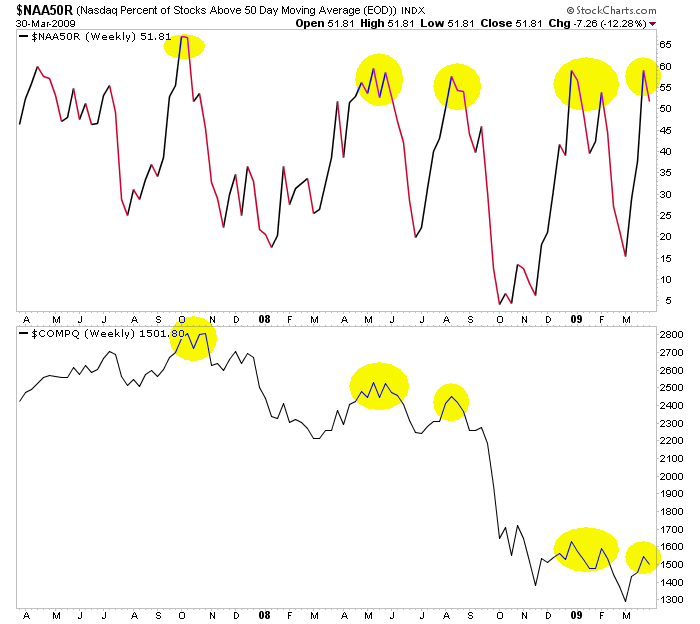

Percentage of Nasdaq stocks above their 50-day MA: It has reached a level associated with tops and impending sell-offs, not bottoms or the beginning of a continuation move to the upside. Some of this fluff may need to be worked off before a rally that has legs begins.

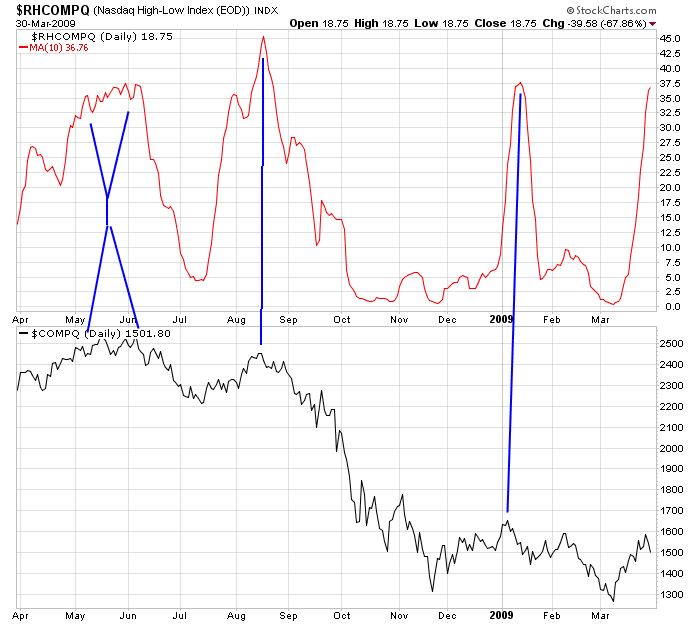

Nasdaq High-Low Index: During the bear market, the current high reading from this 10-day MA chart has been closer associated with tops than bottoms. But it is worth noting the index grinding higher for an entire month in May ’08 before rolling over.

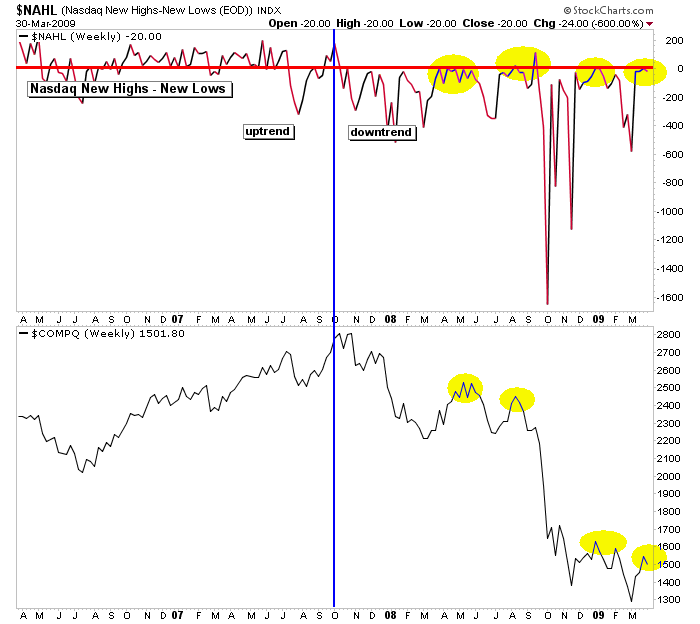

Nasdaq New Highs – New Lows: While in a downtrend, this index spends most of its time below 0. Spikes down have done pretty well identifying local bottoms while moves back to 0 have picked the tops. Right now the reading is near 0, so some fluff may need to be worked off before/if the mini uptrend can continue.

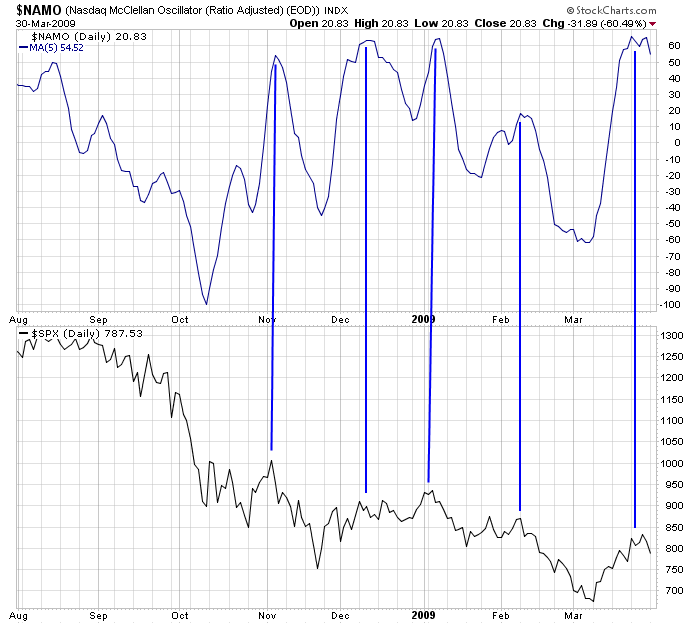

Nasdaq McClellan Oscillator: High relative readings from the 5-day have come at market tops. The only exception being a couple weeks after the Nov low – the market only pulled back for a week.

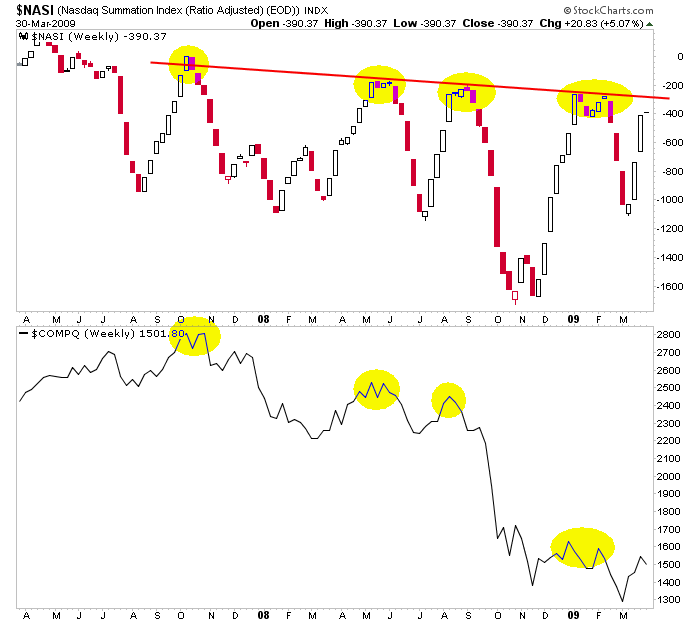

Nasdaq Summation Index: High relative readings from this weekly chart been closely associated with market tops.

I’m not ready to say the mini uptrend which began several weeks ago is over, but per these charts (and a few that were posted in the weekly report two weekends ago), some fluff may still need to be worked off first.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases