Good morning. Happy Monday. Hope you had a nice weekend.

Last week was a wild one….several gaps…a few gap fills…on four occasions the market made a new high…lots of up and down random action. It was fun to day trade but a little frustrating to swing trade. That’s ok. We had many great breakout plays off the lows, and last week was a “let’s let the charts re-set” week.

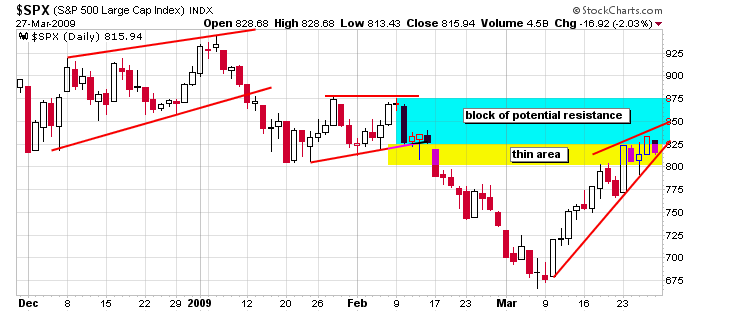

Here’s the daily chart. The SPX traded through the thin area and couldn’t make much headway into the block of resistance marked.

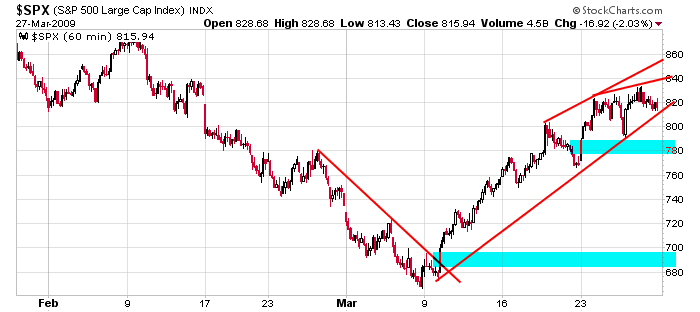

Here’s the 60-min chart. The price action is tightening, and we still have two unfilled gaps below. The most recent one near 770 could fill without destroying the uptrend. The one off the low shouldn’t fill until the market is ready to leg down again.

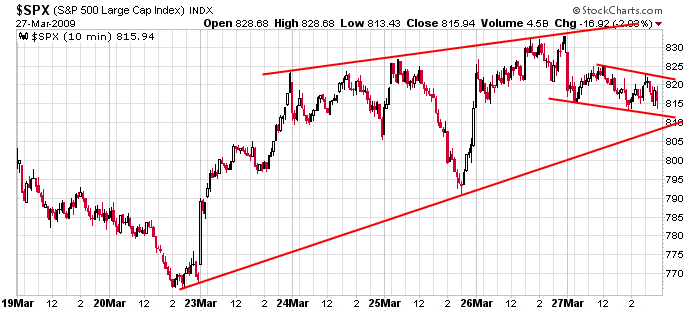

Here’s a close-up of the tightening action. We have a falling rectangle pattern within a rising wedge. Something has to give.

Per the premarket futures, the SPX will open well below the bottom of the rising wedge, and as stated in yesterday’s report – before we knew where the market would open – don’t be surprised if the market breaks down, sucks in some shorts, fills that gap near 770 and then rallies again.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases