Good morning. Happy Friday.

Leavitt Brothers is offering a membership special right now ->> buy an annual membership, get a free month. It averages out to about $38.50 per month – a great deal considering the quality and quantity of stocks picks we offer…not to mention our during-trading-hours and after-trading-hours analysis. To sign up, click the BECOME A MEMBER tab above. We’ll add the extra month after you sign up.

It’s been a wild week. We had big gap ups on Mon, Wed, Thurs and a big gap down on Tues (and today). The Mon and Thurs gaps remain unfilled.

Three different days (Mon, Wed and Thurs), new highs were registered.

Only once this week (yesterday) did the SPX move in a range less than 20 points.

Lots of gaps…lots of intraday movement. Day trader’s paradise, and somewhat frustrating for swing traders, but if you have the ability to get in and ignore the intraday noise, here we are near the highs.

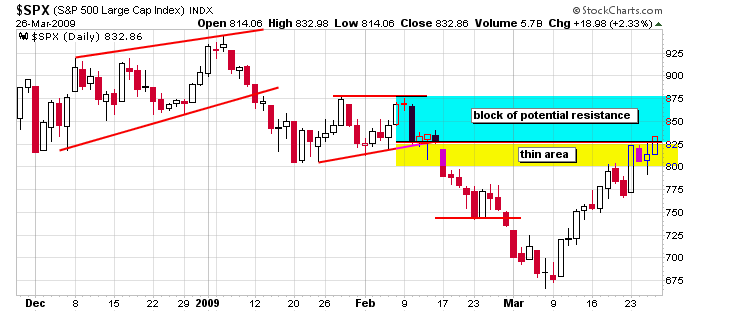

Here’s the daily chart. The SPX traded through its thin area and is now into what I consider to be a block of resistance.

Anything goes today. I can make a case for a parabolic move up that completely breaks the backs of the bears, but I can also make a case the market has gone too far too fast and is still in need of a break. I’ll be watching early for clues. Next Tues is the last day of Mar and Q1. The whole concept of ‘window dressing; is a real phenomenon, but it usually doesn’t last until the very last day. Traders are front running it. That means today could be a big up day, and Mon and Tues could be profit taking days.

Be on your toes. Anything goes.

headlines at Yahoo Finance

stocks to watch MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases