Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. India rallied 1.7% – it was the only 1% mover. Europe is currently mostly up. Greece is down 3.3%; Austria, Belgium, France and London are up at least 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is up slightly. Oil and copper are up. Gold and silver are up.

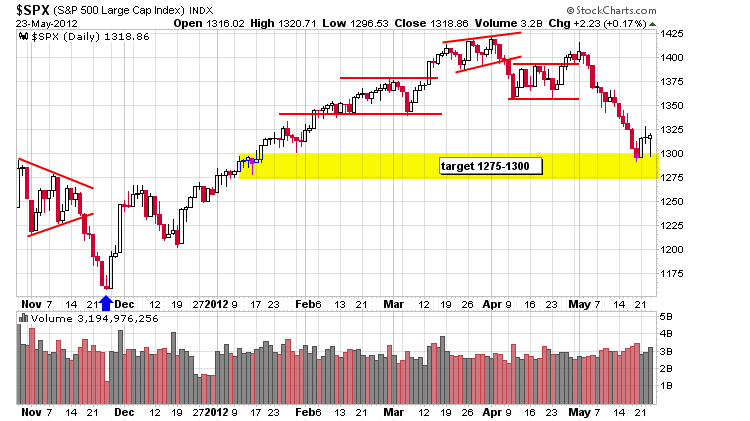

It looks like scenario #2 may be in the beginning stages. Scenario #2 was “we need a test of the low before the real move up can begin.” I’m not predicting the indexes will be off to the races soon, but I am saying to be flexible and open-minded. The unexpected does happen, and if you think so much damage has been done to the charts that the market can’t possibly rally for more than a few days, look no further than last November when the S&P broke down from a symmetrical triangle pattern and then rallied straight up 100 points before settling in a steady uptrend.

Again, I’m not predicting this, just saying be open-minded because suprises do happen when you least expect them.

In my opinion, Europe still rules. When bad news comes out of Greece and the US market ignores the news and moves up anyways, you’ll know Greece no long matters. Right now this isn’t the case. Right now Greece still matters.

Hewlett-Packard is laying off 27,000 employees. The most shocking part is that’s only 8% of their workforce because they have 350K workers world wide. HP wants to be IBM, but they aren’t even close. The stock is up in premarket trading.

COST did well with earnings and is up 1% before the open.

All of today’s economic numbers come before the opening bell, so the normal forces of supply and demand should rule.

Right now my upside S&P target is 1360. After that, I’ll re-evaluate. It’ll all depend on how the market acts when news is released. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 24)”

Leave a Reply

You must be logged in to post a comment.

Getting old. It is not just a trade but loss of faith in our institutions. On the edge is no where to live.

If we retest 1295 it would be the third time. Many third tests do not hold.

ACI continues to be a great trader. moving between 7.64 – 7.17 and bouncing around all the way down within 45 min

AMAT has been strong since their and especially dells earnings report. I would like to rebuy

some under 10.40. I continue to trade around a small posistion in AA and would like to rebuy some under 8.40. I add on fear and reality and sell on hope and speculation of a recovery in the economy. I like to trade unloved, neglected and especially high short intrest stocks.

If there’s a run on the Euro then it’ll be tough to trade and scalping will be the only way to make it. A run on the Euro will increase demand for the USD, bonds, and equities. Commodity prices and US exports will decrease, Gold will go crazy and Neil, in a last ditch hope to perpetuate the DOW 13000 dream, will pay people to wear the T-shirts thus (inadvertently) stimulating the economy just enough to turn things around and once again diminutive Neil saves the financial world.

I recently went to a grocery store and was amazed at the increase in prices. I think we are already in stagflation, the worst possible environ

volitility disappeared we seem to be propped up here I smell a skanke nanke

I hope to have sense enough to be loaded and slow to sell when the usd starts down.

especially commodities

some kind of hope out of europia would be a great shot in the arm for the euro. that would bring usd down and light the fuse on the rocket pointed up the short butt. ACI woohoo

ES futures contracts are stair stepping down. No volume those contracts, but still don’t look good for the SPX.

I was just thinking about how the market could be releaving oversold conditions before another leg down. kind of like consolidating before another leg up, but in reverse.

If europia doesn’t start fixing greece up with some fresh dough, that would seem a natural scenerio

will be interesting to see if ws will take their shorts into the 3 day weekend.

on the subject of IRA’s AA and AMAT are at 3 yr lows and ACI 12 yr