Good morning. Happy Friday.

The Asian/Pacific markets closed mixed and with a bearish bias. Indonesia dropped 2.1%; nothing else moved more than 1%. Europe is currently mixed. Greece is down 1.2%; there are no other 1% movers. Futures here in the States point towards a flat open for the cash market.

The dollar is flat. Oil and copper are up. Gold is up, silver down.

The market is closed on Monday for Memorial Day, so we have a 3-day weekend ahead of us.

The market has been all over the map this week. It rallied Monday…continued the rally early Tuesday but then sold off into the close…continued the sell-off early Wednesday and then reversed mid day and rallied (this marked a successful test of the lows)…then yesterday the market was up early, sluggish for a big chunk in the middle of the day, the strong into close. We’ve gotten a couple ups and downs, and the net is a pretty good up week so far. It’s been heaven for day traders but frustrating for swing traders who prefer a directional move instead of the ups and downs.

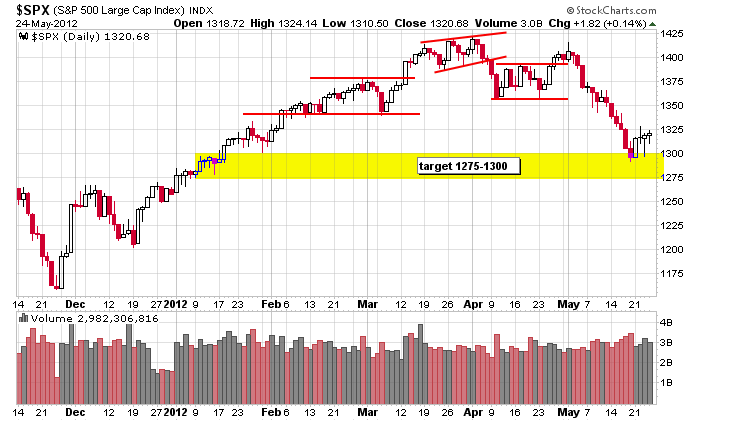

Europe still rules. At any time good or bad news can quickly induce a big sell-off or rally. The good news is the market is factoring in possible scenarios (if Greece leaves the EU, it won’t be a big surprise), and while clearing up the uncertainty would be a big boost, the problems can linger for a long time. Here’s the S&P daily. A bounce to 1360 is doable if we don’t get bad news this weekend. Or we can get a continuation of the 30-point range that has formed the last six days.

Be defensive here. The near term is unclear. Have a good day and a good long weekend.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 25)”

Leave a Reply

You must be logged in to post a comment.

A .30 drop to 7.00 at the open in ACI would not surprise me and I would buy a little and start a posistion

dropped exactly .30 7.37 – 7.07

sold AMAT 10.57 bought yesterday 10.40 10.30. was down 4% yesterday up 2% today. fast money

Russ can u talk indexes—i dont trade shares–they are just pawns

please give me ur opinion on the ftse-dax- n225-axjo- ym-es-nq dji-spx-nas -euro yen usd-aud

ok I’ll look this weekend. single high betas have a lot more volitity you know.

vol low today. must be sneakin out to start the 3 day. member don’t short a dull market. specially this one. later

ps b4 i go usd is way way overbought against everything. short it when greece is taken off thr grill

if u lile volitility go to russell

the rut is really the big boy index

yes ,agreed usd

euro at current support 1.25,but after a bounce target is 1.18

currencies i dont trade as they have to much funny mental announcements connected to them

but they are a good indicator to equity futures

also the fed and other cental banks use currencies to pop the equity markets

spread a little funny money around

buy ur chinesse yaun at a local bank this w/e before its to late

my tick ind is nutral indicating a dull market

but the ym m2-dow has been in a steady downtrend for the past 10 hours

now thats to long even for me

a good trade lasts 30 minutes or i get bored

insto selling presure has decreased but not yet turned to accumulation as the retailers are still to bullish and not enough puts have been bought yet

go the derivitives–they should be banned to have a real market