Good morning. Happy Wednesday.

First the important news. Naked Pizza is opening its first location in Chicago today. My brother has the franchise rights in the city. He and his team will be opening 8-10 locations in the next couple years. If you’re in Chicago, check it out (953 W. Diversey Pkwy). Here are a few of the write-ups in the local media. metromix redeye q101. :))

Moving on…

The Asian/Pacific markets closed mostly down. Hong Kong lost almost 2%, Taiwan more than 1%. Europe is pretty much down across the board. Greece is down more than 3% and France, Stockholm and London around 1%. Futures here in the States point towards a large gap down from the cash market.

The dollar is up. Oil and copper are down more than 1%. Gold and silver are down.

Spain remains a top headline story. 10-year borrowing costs hit 6.67% – close to the level at which Ireland and Greece needed bailouts.

10-year yields in Italy topped 6% for the first time this year.

The euro dropped to its lowest level in two years.

RIMM has hired JP Morgan and RBC to advise it on its “options.” This means the company will be chopped in pieces and put on the selling block. It’s phone business is worthless (they posted an operating loss in the first quarter), but its patent portfolio is definitely worth several billion dollars…ergo the company is worth more dead than alive.

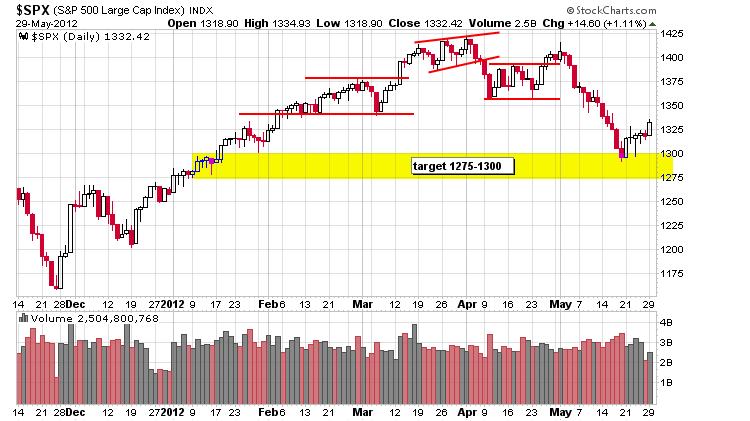

The market did well yesterday. Spain was downgraded. The market initially sold off, but buyers eventually stepped in and pushed prices back to their intraday highs. When the market can shrug off bad news and move up, it’s a sign the downtrend may be close to an end. But it won’t be easy. Technically there’s a big block of overhead supply to contend with and Europe still rules the day. Hence there’s lots of uncertainty in the near term.

Be conservative in the near term. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 30)”

Leave a Reply

You must be logged in to post a comment.

nasquack bounces off the 200. intc down only 2 cents. I smell a skanke behind the curtain

And what do skanks smell like?

your finger

RIMM’s “patent portfolio is definitely worth several billion dollars”.

According to a RIMM analyst, only after RIMM goes through bankruptcy.

Most of RIMM’s patents are licensed to other companies.

RIMM must go through bankruptcy to break the licenses (this is how Palm and others did it).

uncle benanke has to fight a falling euro and its bearish implications for the equity markets world wide

my next target for euro is 1.18

come on china –i want some bull to short,or am i doomed to being a daytrader for ever–lol

usd sure squashed oil and commodities right in the bud

we will have to get Pete to tell the fed ,when to expect a elliott wave 2 bounce,so the plunge protection team can go to work

but the fed is only as good as it has the support of the instos,whom dont look like they have finished selling yet

LOL

little peters charts upside down… doesn’t matter lol

1310 straight ahead capin load torpedos full ramming speed ahead

will spx 1311 do u Russ,but imo selling will end at london ftse 5000 and german dax 6000,but only a opinion for another day–not fact

just a bounce on the way to the 3rd test of 1295 imho. fuqin gartman fuqd up aci 7 cents from my buy. bastard

the bigest tick indicator negative extreme i have seen in a long while

have the instos exhausted their selling

price showing relative strength compared to tick

anyone for dow 12000 t shirts

personally i want a dow 2000 t shirt

my pet teddy bear ,called cudely,wants a dow 1200 t shirt

all the bulls in spain have turned into forochious bears

does my exhileration indicate we may be ready for a bounce

or perhaps a alien spaceship is coming to take me away

bought a small piece of ACI 6.93. had to move my bid up from 6.90 after gartman opened his fat mouth on cnbc

imo world indexes or futures are much more fun to trade than individual shares

with indexes u only have to worry about bumbling uncle ben of the fed opening his

irrational exhuberant mouth

him and timmy are holding hands in some corner under a blanket. they see dead markets