Good morning. Happy Tuesday. Hope you had a good weekend.

Yesterday, while the US market was closed, the world markets closed mostly up. Australia, Brazil, China, Singapore, Hong Kong and India rallied; Germany and spain dropped; Canada, France, Japan and London were little changed.

Today, the world markets have picked up where they left off yesterday. The Asian/Pacific markets are up across the board. Taiwan closed up almost 3%; Australia, China, Hong Kong and South Korea moved up at least 1%. Europe is currently mostly up, but gains are small. Greece is down 1.1%; Stockholm is up 1%. Futures here in the States point towads a moderate gap up open for the cash market.

The dollar is down slightly. Oil and copper are up. Gold is flat; silver is down.

Considering we’re coming off a 3-day weekend, there isn’t much market moving news out. Perhaps that’s the biggest reason futures are up – a lack of bad news.

Spanish 10-year bond yields are near 6.5% – not terribly far from the 7% level many consider to threshold that would trigger serious problems.

Spanish retail sales dropped almost 10% yoy.

Italian 2-year note yields moved up from 3.36% to 4.037%.

The unemployment rate in Japan rose 10 basis points to 4.6%.

JP Morgan sold $25 billion of profitable securities to cover their recent multi billion dollar derivatives loss.

Case-Shiller will come out 30 min before the open and consumer confidence 30 min after.

The market closed up 4 of 5 days last week and put in its first weekly gain in 4 weeks. It’s a start, but within a downtrend, the first move up is the easy one. Now the bulls need some follow through with a little energy behind the move. Otherwise this is likely to be just a dead-cat bounce within a downtrend.

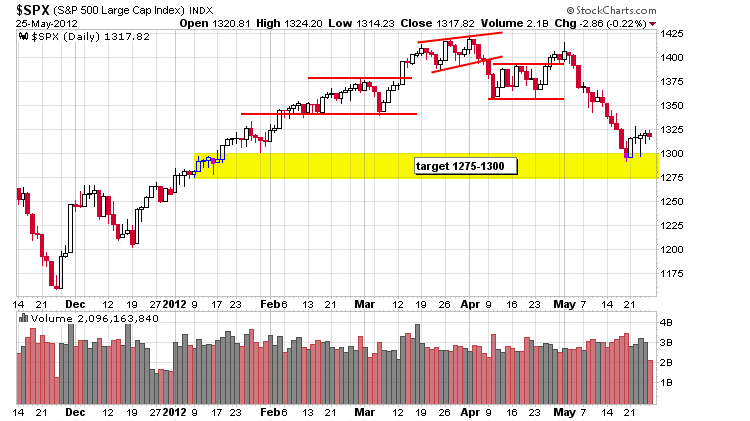

Here’s the daily S&P chart. My target was hit, and now the index is moving up. My two upside targets are 1340 and 1360. Those are doable, but then we’ll run into a block of overhead supply.

Be open-minded. Be flexible. The market is fragile here and could move quickly in either direction based on news out of Europe. You never know. Have a plan and don’t dig your feet in the ground and fight for what you believe. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (May 29)”

Leave a Reply

You must be logged in to post a comment.

taz – whoever (fed) propped the markets up above their 200demas the last 5 days plans on keeping them there.

Lots of happy talk, but nothing has changed in EU except the coalition for common sense was desolved by the French.

The FBP Friday is going to be another nonstarter solving nothing. It is a nowhere economy. Then the summer goes to hell as the long shadow of the Fiscal Cliff casts a dark cloud on everything. We know Congress can not do anything in a few months and Fed has down it all and reluctant to be considered toothless. That is the prelude to a long slid into the bogs, but it will seem better …..until the water pulls you under. BUT we are still day hoping for 1323; we are pathic.

NFP (nonfarm payroll) AKA the voice of God!

thats it shows over. markets locked up you had your may sell off move along

the euro moving down through 1.25 support just now,seems to have significance

for the equity markets and just as london and germany were closing

or was it a head fake down

how long can china prop up europe and the euro

spx and ndx futures stoping at main piviot ,dow the strongest

steel copper and aluminum up on chinas stimulus over the weekend

Jason,

my two pet dead cats–grusome and awesome are refusing to bounce very high

perhaps i should feed them

you ever hear of the dead cat wave? you should have the soggy bottom boys analyze em

waves 1 to wave 9

they are reported to have 9 cycles or lives

thats no cat. thats sharon stone