Good morning. Happy Friday. Happy Employment Numbers Day.

The Asian/Pacific markets closed down across the board. Taiwan dropped 2.7% and Japan, New Zealand and Singapore dropped around 1%. Europe is currently down across the board. Greece is down 3.7%, Germany and Stockholm more than 2%, and Austria, Belgium, France, Norway and Switzerland more than 1%. Prior to the employment numbers, futures here in the States pointed towards a large gap down open for the cash market.

The dollar is up. Oil is down almost 3%, copper more than 1%. Gold and silver are down.

Here are the numbers…

unemployment rate: up to 8.2% (from 8.1%)

nonfarm payrolls: up 69K

private payrolls: up 82K

average workweek: 34.4 hours (up 0.1 hours)

hourly earnings: $23.41 (up 2 cents)

These are horrendous numbers, and to make matters worse, the March and April numbers were revised down.

The futures’ reaction was to sell off hard. They went from being down 15 to being down almost 30 in a split second.

Oil is now down > 4%. Gold and silver on the other hand jumped straight up and are now positive.

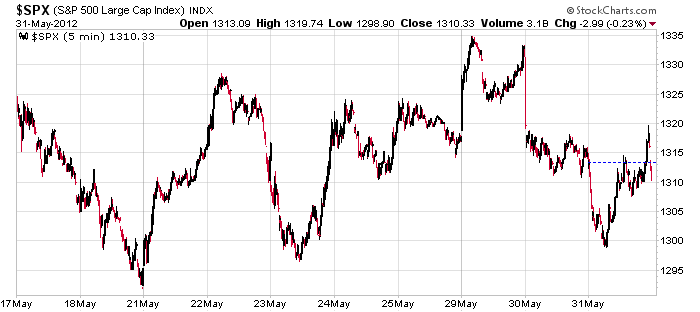

This is what the market has done the last 10 days. Several up and down moves, several sudden reversals, a handful of gaps and after 10 days the index was mostly unchanged. This is great is you’re a day trader who likes to fade moves, but if you prefer a directional market, the last 10 days have not been fun to play with.

As of now, the S&P is set to open at a new low. Just a couple days ago it was near a 2-week high. Now it’s at a new low. A month ago Obama was writing his acceptance speech for being re-elected President. It’s not a lock any more.

The intermediate term trend has been down for about four weeks. The near term, thanks to up and down movement in the chart above, has been unclear, but this has now changed. I’ve been preaching for a couple weeks to not take big chances, to not place big bets, to conserve capital. Hopefully you listened. The market has been held hostage to whatever news was crossing the wires, and that’s not an environment for technical traders to be very active. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 1)”

Leave a Reply

You must be logged in to post a comment.

Can we get a copy of his speech? The bird cage needs a new bottom.

200 at 1284

bought aci pre market 6.17 6.07 sold 6.33 6.43

looks like you boys may get another chance to buy at 6.10. look at a 1 yr chart. put some in your IRA

i am cheif sitting bear,-my son is called grisley bear,my daughter is called impulsive bear

i have a pet bear called teddy–all of us have been ferousus lattey but with the oz winter approaching we may go into hibination shortly

you don’t have faith your uncle ben will save you? maybe they’re just giving 401joe a great buy in

quack 200 at 2757

cok sukers took it to 1283 one point below the 200 and just held it for 10 min to shake out the timid. blurring the lines. ws don’t pass up a chance to deceive. this exactly why waves don’t work. anything well known and used by the public is used as bait

well u certainly have to have the mind set of a big boy insto not that of a retailer playing with retailer lagging indicators

yep. gotta know the players. wave lemmings, it’s whats for dinner

who was on here 2 months ago telling us it’s an election yr? bama mama better crack the whip LOL thats funny a black man whippin white boys. a black cracker

lol skankes blabbermouth leisman is slobbering

bama will have timmy pump the market during his speech to show us wall street and the world loved it and loves him

next obvious support would be 1257 so… Suprise HIdden supporT or SHIT would be 20 pts higher

at 1277

huuurah you wall st bastards we’ve got your fukin number. bought ACI 6.21