Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed mostly down. Indonesia dropped almost 4%. Australia, China, Hong Kong, South Korea and Taiwan dropped more than 2%; Malaysia, Japan, New Zealand and Singapore dropped more than 1%. Europe is currently mixed. Norway (down 1.3%) is the only 1% mover. Futures here in the States point towards a positive open for the cash market.

The dollar is down slightly. Oil and copper are down. Gold and silver are down.

China’s nonmanufacturing Purchasing Manager’s Index for May dropped from 56.1 to 55.2. There was hope the services sector could pick up some slack from the slowing manufacturing sector.

Portugal is injecting money into three of its biggest banks. This is news because we’ve heard a lot about Greece, Italy and Spain, but this is the first time in a long time we’ve seen Portugal (they’re the P in PIIGS) in the news.

The Japanese market hit a 28-year low.

Oil is at an 8-month low.

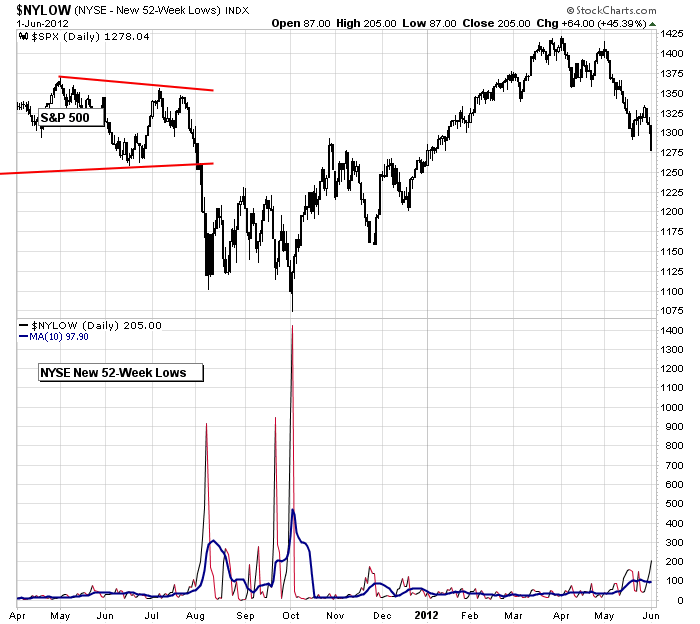

The market is broken on many levels. From a technical standpoint, the indexes are in downtrends and just Friday broke down from two weeks of consolidation. From a fundamental standpoint, economic numbers have gotten worse the last month, and the big number (the lastest employment report) stunned Wall St. From a psychological standpoint, fear is rising. Heck investors would rather buy bonds at 1.5% than invest in the stock market.

Added up the market is in bad shape, but it’s not in washout mode yet. As an example, here’s a chart I’ll be watching. It’s the S&P 500 vs. the NYSE 52-week lows. When new lows spike up like they did in August, September and October, you know the bulls have completely given up. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 4)”

Leave a Reply

You must be logged in to post a comment.

bought some ACI 6.11

I’m confused about the statement above about when the NYSE spikes the bulls have thrown in the towel. From my perspective, this is when the bulls step in, start buying, and put a bottom in the market.

It is good to be s spread/range trader, your short and long at the same time. You don’t get wiped out by being a purely directional trader but you don’t get rich over night either.

All I can say is I hope your wearing your rain coats becuase it is raining shit and will continue to do so.

New LOWs chart, equities making new LOWS not new HIGHS.

Re: spreads Credit or Debit?

2 diff things smart bulls vs dunb bulls lol. sold aci for 3% gain. thats smart bull.

wall st goes to a lot of effort to move the market up and down. I try to not waste any of those moves

bid 6.01 bounced at 6.03. if we go to 1257 may get another shot

a swarm of bulls may be approaching soon as the fed and cental banks close out their shorts

and create a bounce

but they will need the bleasing of the big boy bank instos

of course nothing can save europe apart from germany leaving europe and a falling euro

but what would a soaring deautch mark cost

citi bank london now offereing yaun based a/cs

chinesse yaun to take over the world as the reserve currency

and the usd is doomed with the bleasing of the fed and the usa pollies

god save ammerica because the fed or govt wont

german dax testing 6000 support –now thats smart bull

and a secret code for the rest of the world ,that may have exhausted on monday

lol smart bull needs to dump greased cow

I’m sensing a turn up