Good morning. Happy Tuesday.

We entered yesterday with me thinking either a big down day or a couple grinding down days were needed to allow the overbought indicators to pull back and the charts to reset. But it wasn’t to be. A big gap up was bought, and it became obvious early the odds of a runaway market were high.

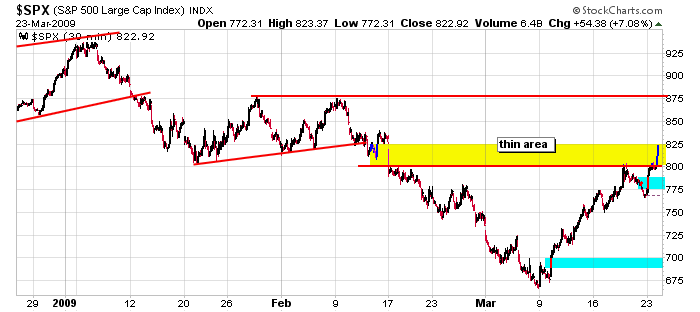

Here’s the 30-min SPX chart. We are through the thin area I identified last week and up against another resistance level (825) which I think is more significant than 800.

But as I’ve stated from time to time over the past few weeks, support and resistance and the various technical indicators are less meaningful today than they typically are. Wall St. works best when the true forces of supply and demand result from fundamentalists calculating where prices should be and technicians studying where prices are, but when you throw Washington into the mix, nobody knows how to value a stock or whether the current prices should hold.

Bottom line…when Washington plays such a big role, you can’t trust the charts as much.

The trend is up; sentiment is bullish. Ultimately I believe this will be a big bull trap and the lows will be revisiting, but for the time being, there’s no way I’m stepping in front of this runaway train.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases