Good morning. Happy Monday. Hope you had a nice weekend.

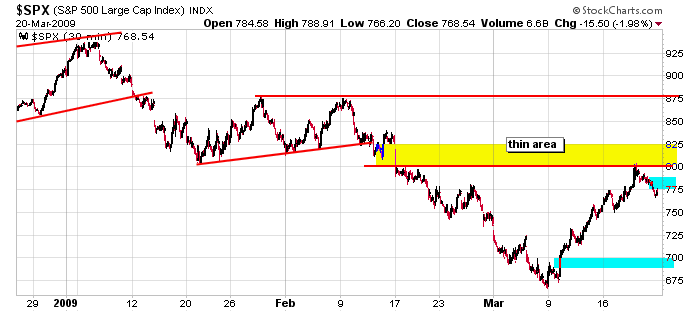

Last week the market rallied into and out of the FOMC meeting but then sold off Thursday and Friday. SPX 800 proved to be a tough level to overcome. That’s ok. The market needed to rest. Besides resistance levels coming into play on all the daily index charts, numerous internal indicators we follow (put/call, VIX, McClellan Oscillator, tick) were at levels that have typical led to weakness, not continued strength. Hence, a little backing and filling was needed.

Heading into this new week, I was looking for a little more weakness or at least enough sideways trading to allow the charts to re-set. We’ve had some great breakouts the last couple weeks, but now the charts are a mess. But there will be no weakness at today’s open. Nas 100 futures are up 25 and SPX futures are up 20. If these levels hold until the open, the market will open near Friday’s high. The media says Wall St. is cheering the Obama administration’s plan to resolve the banking crisis. I’m sure that has something to do with it, but the futures started moving up last night.

Here’s the 30-min SPX chart. We have a thin area between 800 and 825 and assuming the futures don’t tank in the next hour, we’ll have another unfilled gap below.

I scaled out of longs late last week. Now I’m day trading and waiting for the charts to reset.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases