Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up. Australia, Indonesia, Japan, South Korea and Taiwan rallied more than 1%. Europe is currently trading mixed and with a bullish bias. Greece is down 4%; no other index has moved more than 1%. Futures here in the States are flat.

The dollar is up. Oil and copper are down. Gold and silver are down.

Google is buying Meebo, but before the announcement was made, Meebo laid off 90% of its workforce. Ouch.

Starbucks is buying San Francisco based Bay Bread (La Boulange). There are many in the Bay area not happy. They want a ma and pop operation, not Starbucks.

Spain has officially made its first plea to the EU for aid to help shore up its banks.

G7 finance ministers and central bankers are holding an emergency conference call today to discuss Europe.

Australia cut its interest rate by 25 basis points.

No matter how you look at the market, it’s in bad shape. But it’s not in bad enough shape to support an extended move up. If the market bounces here, it’ll get sold into. But if we can get a total washout (new lows spike, put/call spikes, VIX spikes, ATR spikes), then we can get a rally that lasts at least a couple weeks.

Europe still rules. There are lots of cat and mouse games going on. Someone could blink at any time and send the market quickly up or down. The trends (short and intermediate term) are down, but have a plan for all realistic scenarios. What if the market bounces hard? How will you play it?

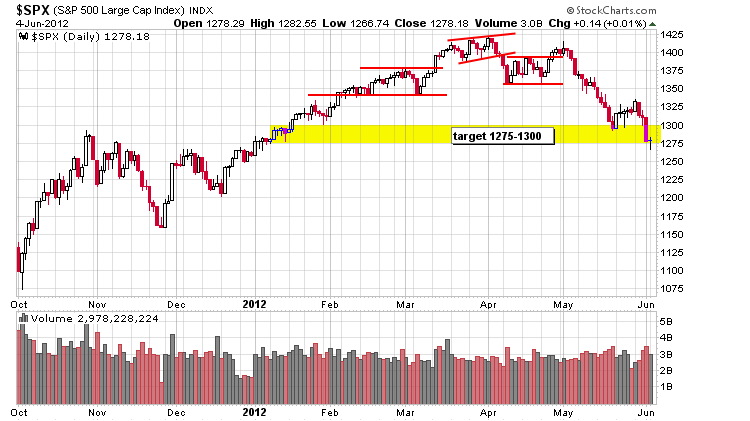

Here’s the S&P daily. It dropped to my target zone (1275-1300) on increasing volume last week. A bounce could certainly play out here, but until it makes a higher high, I’ll question whether any move up has legs. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 5)”

Leave a Reply

You must be logged in to post a comment.

there still is no fear. time for the matador to step it up

“Bear markets operate within a background of naked fear.”

did you see my last post yesterday? sold aci 6.46. a swift slice to the bulls nads. that slowed him down a little

Russ, congrats on all your great ACI trades. It seems like you trade what you know and do it extremely well.

thanks Aaron, trading commodities are like boxing in the sence that when you get them in a corner you can beat the hell out of them 🙂

looks like others sold into the rally also. don’t try to squeeze a bears nuts 🙂

come on little piggys your table is ready your butch errr… waiter will be right with you

taz they wont come back out. I’ll put my bull costume back on and go get em. bought aci 6.24

positive divergence set up on the stochastics. rsi pegged. guidence raised on coal yesterday.

market way oversold. come on Rich buy some aci and we’ll run with the bulls!

Realistic calls,Jason

Russ still using retailer indicators –so do i occasionally

here is my take on it

it was high noon and not a bull nor bear was moving,indicating supply and demand were matching

my tick indicator was flat to slighly negative–no tick extremes–indicating supply was getting bought

all in all a doji stalemate

as a wave expert we are at suport levels and character that could indicate a completed impulsive 5 waves down,ready for a corrective wave 2 up to 50%-75% of the down,but the bears nuts have not been pricked yet

thats the veiw of this nutty bear daytrader that relys only on insto indicators of pit trader piviots and ticks ect

close. just take out the wave crap and insert nov and dec 2011 tops

buls and bears cant make a move till the queen stops party-ing and the bigest financial centre in the world –london reopens

skankie is wrestling a griz. great show. he keeps throwing money on it, but it wants blood

you know what the queen smells like? depends

Starbucks is run by a Scientologist —go Swartzy

save me tom cruise

skankies trying to squeeze the bears nuts, but it’s just making the bear madder and madder get in there Rich

we are getting some wide tick swings now—good for the daytrader

intc up exactly 2% there’s your skankie tell

I sold a truck load SPY 126 puts a couple of weeks ago. I need you guys to rob your kids piggy banks and keep the SPY above 126 until Friday June 15th close.

All other positions are in good shape (especially those high level calls I sold).

morgan stanly up 3% is proof your uncle been has his finger in the dike

vxo back under the 200dma looks like skankie kicked the bear in the nuts