Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. South Korea rallied 2.6%, Australia and Japan more than 1%. Europe is currently up across the board. Greece and Stockholm are up more than 3%, Austria and the Czech Republic more than 2%, France, Germany and London more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

The big news out this morning is China cut interest rates by 25 basis points. They often cut their reserve requirement, but this is the first rate cut since 2008. They’d only do it if they felt the economy needed it, so the hidden message here isn’t a good one. S&P futures jumped 10 points on the news – the futures entire gain.

The Bank of England kept its own interest rate the same at 0.5%.

Bernanke will speak before the Joint Economic Committee today, 30 minutes after the open. He’ll be talking about the economic outlook.

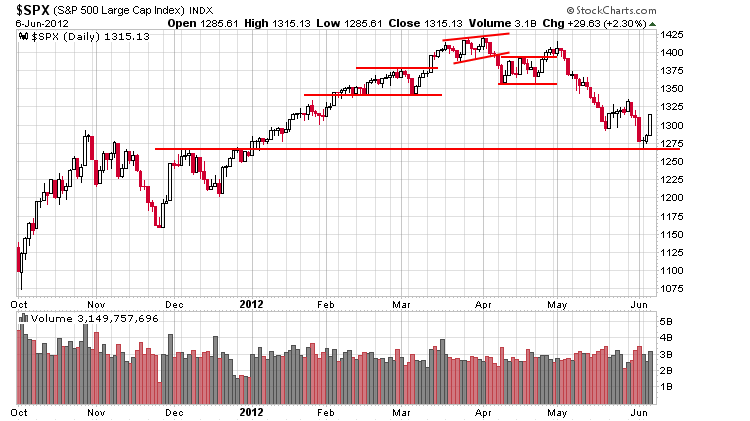

The market got clobbered last Friday after the latest employment numbers were released. Those losses have now been recovered. The first move off a local bottom is the easy move. Sentiment is overly stacked on one side, and once sellers start to thin out, it’s not hard for the market to bounce forcefully. The combination of bottom fishing and short covering can produce some pretty quick and energetic moves. The biggest moves, after all, tend to come during downtrends. But after a couple days of bouncing, real buying needs to take place. Otherwise the bounce ends up being an innocent bounce within a downtrend instead of a the beginning of an uptrend. I’d say we’re there right now – the easy stuff is done, now it gets harder. Yesterday was easy, but for the bounce to continue today and tomorrow, that would be impressive – at least in the near term. Here’s the daily S&P. Coincidentally the index bounces off its early December high.

The current situation is not easy to trade because we don’t know if this is just a bounce within a downtrend or the beginning of an uptrend. If you give shorts room to move against you within the downtrend, you could give back most or all of your profits before you find out the answer to this question. Becasue of this you have to decide ahead of time how long you anticipate holding – you don’t determine this in the heat of the moment. You’re either the type of trader who takes quick profits and looks for the next entry or you ride out the bounces with loose stops. Both work fine, but I don’t suggest you switch back and forth. Have a plan and stick to it. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 7)”

Leave a Reply

You must be logged in to post a comment.

i have disposed of my pet dead cats–gruesome and awesome–they wouldnt bounce

i now have 2 new ones named uncle ben and big ponsi

i call my pet piggy bank retail indicator.

and i call Aarons pet cramer dumbass

How did you know my pets name was Cramer, my other pets name is “Fast Money”. I watch CNBC all day to get good trading tips.

You can throw fundamentals and technical analysis out the window…The truth sayers on the TV will lead you to riches.

hahaha

High volume on yesterday’s close, high volume on today’s open, ESM12 rolling to ESU12, Hmmmm, how expensive were the cats?

Jason:

Do you give any credibility to the island reversal chart pattern on the SPY daily?

Looks like a dead cat bounce to me. Quite strong though none the less but in the current economic climate – unsustainable. The whole market should have been allowed to crash and burn in the GFC instead of being artificially held up by QE’s,

Markets of any type – left to their own devices – always find their own levels.

Had the likes of BB not interfered we would have been out of all this crap and well and truly on the road back to prosperity.

As a result, I believe there is much more downside again and I’m the eternal optimist.

What’s a GFC?

Re: What if; I’ve not been successful at trading, “What ifs”

refreshig to see a new poster. you don’t see bb as the saviour

This is why I’m almost always long and short. I trade ranges.

This is why I’m always broke!

RichE…trade credit spreads.

If we stay in this area right now at the close on 6/15 then I’ll make over 10K.

I like the roll-i- coaster.

to many margiritas

Ok, that’s why I’m broke and drunk.

salute

What a load of crap !–There is no way in hell that the Yanks would be now be on the road to ‘Prosperity’ …!And the Greek situation until resolved or at least a short-term fix will create massive uncertainty.

the global financial crisis of 2008-16

im thinking of becoming a GURU but i cant spel

maybe ill be a nutty guru that smokes

lol

Start your own youtube channel “Stock Market GURU”. I’m sure you will be a sensation and move markets.

The Smoking Guru and his talking animals, Cramer’s already got that spot.

I think you should go Goth. Dead animals that talk. Russ can be a guest.

hahaha I’ll bring rays dog

aci bounced off 6.50 and came down and bounced of yesterdays close of 6.20

autumn is 3 mnths and 13 days away. nat gas is down today. prolly cuz oils up

Russ,

Nat gat is down becuase the people who sit around me at work have hoses up their asses pumping a continuous supply of gas into the pipelines.

you work in a prarriedog town? I see lizbeth works in australia. ever here of them taz?

Russ,

I’ll sell you some ACI $5.90 strike puts. How many would you like to buy?

already been there. I’ll take some 5.5

if we were to put in an inverted h/s we’d be at about the neckline here

sorry Rich, that means upside down lol

Inverted h/s sounds like someone with their head up their ass. Island sounds better, palm trees, grass skits, drinks with umbrellas.

sounds like you live in chicago lol

the adx on the sp600 sm caps shows overbought. from way oversold to overbought in just 3 days

love that up and down. right liz?

GGW order now! greeks gone wild!

all great idea’s guys and galls,but if i went on tv as the as the smoke’n nutty guru,from the island reversal down under,would they let my uncle ben and big ponsi timmy on or would they say it was to political with insider info

I think your video should show them talking, but you would be dubbing in your words

http://www.markettoons.com/

lower the periscope prepare to dive

yep

my radar is picking up a large walrus with a beard and a pocket protecter

What is it with you two and weird animals?

you’ve never seen animal farm?

I don’t remember a walrus.

yeah he was in the water trough he works at a bank now