Good morning. Happy Friday.

The Asian/Pacific markets closed mostly down. Japan dropped 2.1%, Australia, Hong Kong and Taiwan around 1%. Europe is currently mostly down. Only Stockholm (down 1.2%) has moved more than 1%. Futures here in the States point towards a down open for the cash market.

The dollar is up. Oil and copper are down 3%. Gold and silver are down.

Bloomberg is reporting Oil is heading for its longest weekly losing streak in 13 years.

Supposedly Spain will ask the EU for aid on Saturday.

The market got a boost yesterday on news China cut its interest rate 25 basis points (they often cut their reserve requirement but haven’t cut rates since 2008), but the gain quickly disappeared when Bernanke failed to tell Wall St. QE3 was in the pipeline. Wall St. is addicted to stimulus. It doesn’t care what the long term ramifications are. It only cares about what happens to the stock market right now, and since it didn’t get what it wanted, it sold off.

Strong markets rally in the face of bad news. Weak markets drop even when showered with good news. Yesterday was an opportunity for the bulls to show how strong they were, but they didn’t put up a good fight. On a closing basis, the market didn’t do too badly, but relative to where the market was right before Bernanke spoke, the performance was not very good. Today is another day. A good day will enable traders to forget about yesterday and key on the positive week we’re having so far. A down day will make this week’s bounce look more like a dead cat bounce within an uptrend instead of the beginning of a rally.

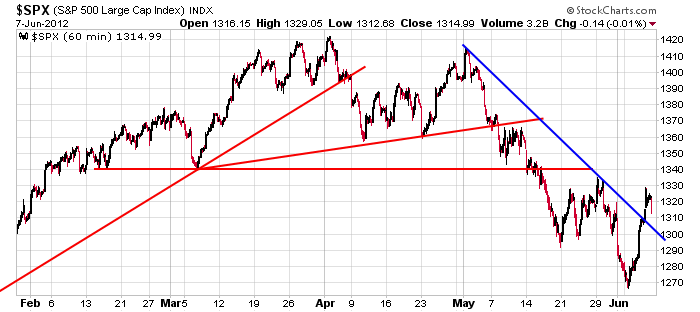

Here’s the 60-min S&P chart. The index moved straight down at the end of May and then straight up. But lower highs and lower lows remain in place. The trend is down until it’s not.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 8)”

Leave a Reply

You must be logged in to post a comment.

a slow 6-10 day drift down to 1290-85 to put in a right shoulder on an inverse h/s (not inverted Rich) lol, may be the feds agenda. to be back up to the inv h/s measurement targert 1360 by the end of the month would be above all ma’s and make a nice print for joelunchboxs

401k statement end of quarter. thats my map until i see something that blows it up lol

Love your closing sentence;

“The trend is _______ until

it’s not.”

@Russ – should I buy some ACI? or short it becuase Obama will hand out lumps on coal on his campaign tour?

I have a theory about a trader picking a vessel to use, to match his strengths and tendicies.

I personally like to bang value off lows ie coal steel and AMAT.

ACI dove to 5.91 and bounced to 6.13 this morning. Sometimes aci then forms a wedge the rest of the day, to diguise it’s next move.

I like commodities because they are a value because they match the real economy because the fed isn’t propping them up because they’re trying to contain inflation.

When the economy really improves and is not just being propped, commodities will have real value. The challenge will be to not be shook out by ws to early on the anticipated recovery

Dammit I missed this one. I was looking at ACI to go long at 6.03 it is now at 6.14. On a day trade like this I only look to make ten cents and would have got it.

thats ok, it went through 6.00 like a hot knife to 5.91. I sold at 6.17 and would love to

see 5.91 again

not slow at all –we have volitility–the daytraders dream

and up tick extremes–follow the ndx–it has all the fun

no such thing as trend thats a retailer saying

big boys only use horizontal suport/resistance as displayed by pit trader piviots,

without those your only a retailer

now as a retailer i say we are in wave 2 up

did you see santellis resistance lines on cnbc last hr? he used to be a pit bond trader

not saying I like all of cnbc. I know they are paid by ws money to deceive and mislead us.

I do like santelli, cashin and ghee, tim and karen on fast money. crammer and piss on e are

used car salesmen and lie all day everyday for a buck.

I think the fed left the market down until after the 1st of the month to allow 401k inflows a good entry.

but cnbc shows us old outdated rearview stats like inflows and outflows to deceive us.

ws pays cnbc to get us out at the bottom where THEY buy. You can actually see piss on e and crammer start talking real loud and slobbering.

even the retailers dow is being controled by piviot points today

A long drawn out h/s pattern would fit the feds agenda of stalling until things improve.

I think the fed will keep volitility (vxo) below the 200d now that they let us have the may selloff to satify those who complained the market was to high to buy, relative to the real economy.

same as the euro and ndx

sold AMAT 10.75 I bought yesterday at 10.61, and bought aa at 8.35. They run at $2.00 apart and right now they are 4% diverged

check out how low this summation is

http://stockcharts.com/freecharts/McSumNASD.htm

sorry wont link. if you’re interested look up Nasdaq McClellan Oscillator, then see the summation. it’s very low and has turned up

short covering fear weekend euro bailout deal, but some rallies have started with s/c

http://online.wsj.com/article/SB10001424052702303753904577454292216102270.html?ru=MKTW&mod=MKTW

competitor mine closures first seen as negitive then positive lol

copper and steel still down. I will wait for ACI to come to me

still see a long drawn out shoulder. borrrrring. at least aa, aci and amat move fairly regulary. patience is not my strong suit

we’ve apparently ran into a walrus named skankie and can’t move. may must be over

we’ve broken through the 20dema where shorts like to short and we should be heading higher

on the break out. this is how you can tell it’s the fed. we’re on lockdown

let’s run “the bernank” again http://www.markettoons.com/

this is NOT a free market. We are a black mans slaves. big government. you can have this much soda. prohibition. comes from the root PROHIBIT. TRADING PROHITITED

bernickie ‘s plung protection team are only retailers using retailers indicators

he has another team called the big boy aluminati instos do the real moving ie the euro

everything follows the euro

china and the ecb are part of the aluminarti as well as japan

all in all the fed is only a small fish and usa markets relativly insignificant

why did jp morgans loss billions

hahaha you want me to send the pms hilary over there and kick some chinese butt?

you saw her take bin and mama ladin out

usa is not even the bigest financial market in the world–london is

where did lehmans go bankrupt–london branch

there broke. we done saw the queens last hurrah.

obama and the chicago mob is runnin the show now

besides you shoulda put the paddles on them cats. better dig em up, they’re late but they’re ready to rumble. rome will rise again

my pet,uncle ben ,is trying to rumble,but rome is burning around him

he will be burning the midnight oil this weekend printing usd euros and euro bonds.

we’re going to buy our way out of this.

our queen, hilary will take a shot of jack daniels and take care of the chinese