Good morning. Happy Friday. Happy Quadruple Witching. Today, the following contracts expire: stock index futures, stock index options, stock options and single stock futures.

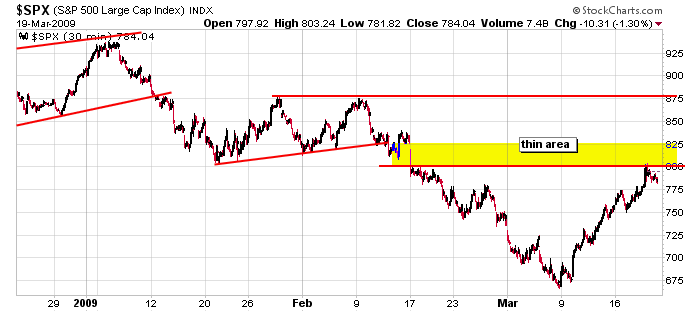

Two things played out yesterday. Resistance at SPX 800 was too stiff to overcome. The level was approached on Wednesday after the FOMC and then again at yesterday’s open. The index got rejected both times. And second, the market once again faded its FOMC move. A rally was seen after the Wednesday announcement, and yesterday everything was given back.

This leaves us exactly where we’ve been the last couple days. Short term, the trend is solidly up, and I personally expect it to continue. But the market is a little overbought and in need of either rest or a nasty down day to cut the excess fluff.

If the market moves up from here, I’ll question its potential legs. Most stock charts have already broken out and are in need or a rest. It’s hard to imagine anyone except the shorts aggressively buying here. But if the market can have that nasty down day to shake the tree a little or a couple days of sideways movement to work off some short term positive sentiment, I think a subsequent breakout could travel further and last long.

Here’s the 30-min SPX chart. Resistance at 800 held; the thin area between 800 and 825 remains; former 780 resistance now becomes potential support.

Be a trader. Nothing wrong with taking money off the table.

headlines at Yahoo Finance

stocks to watch MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases