Good morning. Happy Thursday. A big black hole in America starts today as many people spend more time following the NCAA tourney than working. Good luck with your brackets.

The Fed has spoken. They essentially said they’re going to “print” all the money needed to buy up all the crap necessary to lighten the load on the banks so they can continue to function. This should dilute the heck out of the US dollar, but since most other countries are in worse shape than the US, Ben & Co. may get away with it. I’m not smart enough to know if there’s a tipping point out there with the dollar – a threshold that once passed will cause runaway inflation. The market reacted positively to the news which is what strong markets do. They embrace good news and ignore bad news. Yesterday’s news was positive, and the market surged – exactly what it’s supposed to do. The SPX is now about 125 points off its low. How much further can it go before there’s a meaningful correction?

Let’s look at some charts…

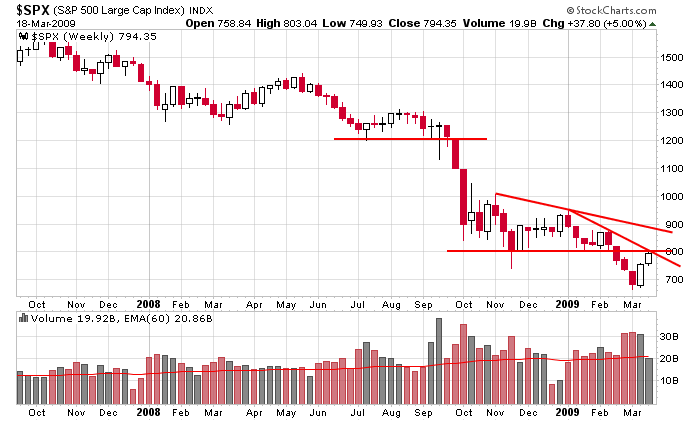

The weekly has resistance at 800 from two different trendlines.

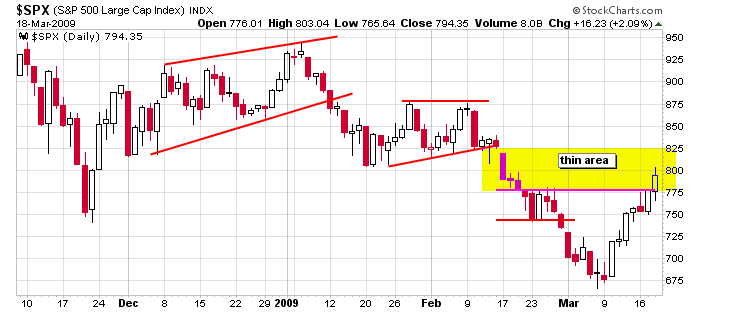

The daily easily overcame resistance at 780 and is now into what I consider a thin trading area. 800 may appear as resistance on the weekly, but I consider 825 stiffer and more important.

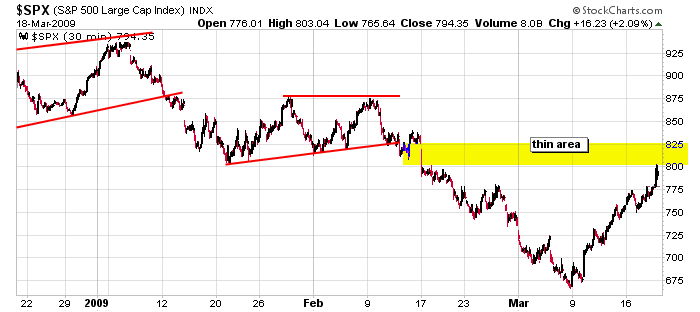

The 30-min highlights the thin area.

Considering the trend and the tendency to move up into options expiration, odds favor a continuation of the rally, but don’t get careless. The market is in need of a pullback or at the very least some sideways consolidation. Don’t fall into the trap of thinking that suddenly all our problems are solved and a new bull market has begun. This is a bear market rally – one that can last several weeks or possible up to two months, but that’s all it is. Be a trader, not a buy and holder.

Go Illinois! Go Texas! :))

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases