Good morning. Happy Tuesday.

Our 1-time, Groupon-like special offer is here.

The Asian/Pacific markets closed mostly down, but only Japan (down 1%) moved more than 1% from its unchanged level. Europe is currently mostly up. Gains are small and Austria and the Czech Republic are down 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are down.

After the biggest up week in several months, we got a gap up and big sell off yesterday – textbook definition of “buy the rumor, sell the news.” Perhaps the selling was overdone…or perhaps the bailout of the Spanish banks really is just a temporary fix that doesn’t solve any of the structural issues. We’ll see. The market is mostly unchanged over the last three weeks, and other than a quick move down at the beginning of June and a quick move up immediatly after, the range has been small. Rallies have gotten sold, dips have gotten bought. We’ve gotten some good moves in both directions, and this by itself tells me there is no dominant short term trend. If there was, we’d either have lots of good long trades or lots of good short trades, not lots of both.

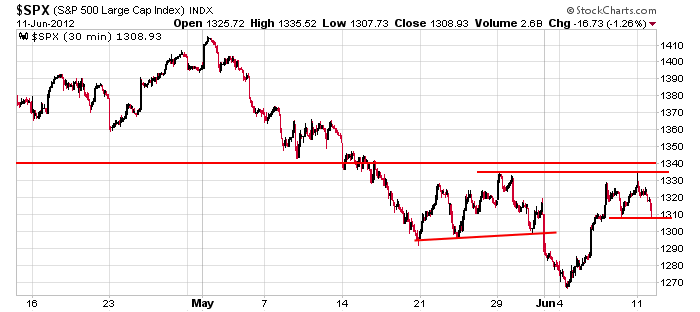

Here’s the 30-min SPX chart. The bulls want to see yesterday’s low hold, or at the very least, 1300 hold.

Spanish bond yields moved from just over 6.5% to ~ 6.66%.

NetJets (owned by Berkshire Hathaway) is buying 425 jets to bolster is fleet.

Bershire Hathaway has offered to buy the mortgage division and loan portfolio of Residential Capital.

Verizon is scraping most of its phone plans in favor of pricing schemes that will allow data to be shares by up to 10 people and on multiple devices such as phones, laptops and tablets.

That’s it for now. A major obstacle in Europe has been removed, but the jury is split on whether it’ll have a lasting effect. Unfortunatly this means news from Europe still dominates. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 12)”

Leave a Reply

You must be logged in to post a comment.

Jason,are you planning an article about OPEX,like you do every third monday?

Oye, totally forgot since it was a short month. Perhaps I’ll do it tomorrow. We’ll see what the numbers look like. Thanks for the reminder.

Increasing bond yields equates to decreasing bond demand. Where’s the bond money going?

women DO need more money. everyone should find a woman that doesn’t work and give her their house

The money’s going into curtains? So I should load up on Martha Stewart?

beer. sell the cans. more you drink the more you make

… and I wouldn’t have to dumpster dive.