Good morning. Happy Wednesday.

Our 1-time, Groupon-like special offer is here.

The Asian/Pacific markets closed with an up bias. New Zealand dropped 1.3%; China rallied 1.3%. Europe is currently mixed. Greece is up 1.4%, Norway and Stockholm are down more than 1%. Futures here in the States point towards a down open for the cash market. This could change when PPI data and retail numbers are released at 8:30 est.

The dollar is down slightly. Oil is down, copper up. Gold is flat, silver down.

Jamie Dimon will be on Capital Hill speaing with the Senate Banking Committee about JPM’s multi-billion dollar loss. He’ll no doubt try to convince the committee banks can be trusted, that they don’t need any oversight or regulation.

DELL is paying a dividend for the first time in company history.

MO announced an $18 billion stock buy back that will take place over 3 years.

CELG is buying back $2.5 billion in stock.

Borrowing costs in Italy (bond yields) have reached a 6-month high.

German yields are low overall but have surged the last two days.

Greeks go to the polls on Sunday which could set in motion Greece’s exit from the euro zone. I mention this mostly so you can gauge the odds the market makes a forceful one-way move into the weekend. Unless there’s reliable survey data, the market is more likely to be choppy than trendy.

Solar stocks were up big yesterday. Today there’s a report solar installations in Q1 jumped 85% relative to Q1 of 2011. But most of the growth came from projects that began prior to Dec 31, 2011 when federal tax credit program expired.

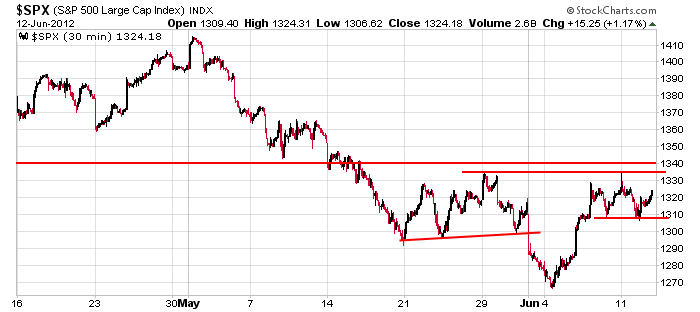

Here’s an update of the 30-min S&P chart. The indexes barely made a lower low yesterday and then rallied. The basing pattern remains in tact; price is unchanged in almost 4 weeks. Dips get bought, rallies sold. Whenever the market is range bound, it’s wise to take partial profits on inital moves because sometimes those moves are the only ones we get. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 13)”

Leave a Reply

You must be logged in to post a comment.

inv h/s on the 500 still in play. the one on the sm cap 600 has already put the 2nd shoulder in

I’m looking to buy back some of what i sold yesterday 3% lower on aa, ac and amat

there are many move possibilities in the market atm

i only feel comfortable on the 1 and 5 minute charts as a snipping scalper

trading is 90% mindset,with the ability to read changing market conditions quickly

vxo is holding right under the 200d in it’s own h/s, which if it holds would be pos for the markets. we are at resistance at 1325-30

thank God they got in there and propped it up before we could get too good a price.

cok sukers. now we can play our favorite game

russ try pork bellies–no futures in roosters

very little Vol behind this thou…..

i sence the quad witches are at work

heavy up tick buying but little price movement

london ftse likly to close as a doji and german dax down a little

had a bid for 5.71 this morning and missed it by .02 as it bounced at 5.72.

so i sold some at 5.99 bought back at 5.79. I can play there game backwards if they want.

fuqin roosters

@Russ – got any ideas on a bottom for ACI? I’d consider going long and holding; however, I’m not into trying to catch falling knives.

if it returns to 5.71 I dont want the whore. moved by bid down 1% to 5.65. We’re in a down trend and have to stay ahead of it and keep moving. use stops and dont hold overnight…

or however you trade

do we have a reason to break through resistance and head higher? no. do we have a reason to go down and put in a shoulder by friday and await the greek election sunday and make russ money? yes. end of story

I’m glad all my options expire on Friday. If Greece votes out of the EU (really they should be kicked out). Then it will rain PIS (Portugal, Italy, and Spain). The

EU can’t kick the can down the road much longer.

obviously we have a big fat walrus sitting on our sandbox and strangling volitility

comon baby come to daddy

to me WS is like the kid that goes out on the rope bridge, acts like its fun and coaxes his little brother and his friends to come out on it. then when they get out to the middle he starts rocking it.

I try to stay in the middle and make money on every move. I hate missing an opertunity and I hate just standing still. no volitility no money

crack ass cramer said he’s having joy global ceo on to sell coal tonight. don’t like or watch him so don’t know what that will be worth. 1/2 – 1%?

ESU12 5d5m: The ‘zigs’ are getting shorter.

took her for 5.73 to sell er at the crap show