Good morning. Happy Friday.

Our 1-time, Groupon-like special offer is here. This offer expires this weekend.

The Asian/Pacific markets closed mostly up. Hong Kong rallied more than 2%, India, Singapore and Taiwan more than 1%. Europe is currently up across the board. Belgium is up 2.5%; Austria, France, Germany, Norway and Greece more than 1%. Futures here in the States point towards a slightly up open for the cash market.

The dollar is flat. Oil and copper are up. Gold is flat, silver down slightly.

Options expire today, but the only thing that matters is the elections in Greece this Sunday. Some Greeks want to leave the EU, others want to stay. It’s divided – polls are split.

We got news yesterday the central banks are standing by ready to act in case there is a need to inject liquidity into the system next week. Hence the strength in Asia and Europe today.

Moody’s downgraded five Dutch banks.

There’s also an election in Egypt. This has implications for the US’s foreign policy in the Middle East.

I’ll repeat what I wrote yesterday – the casino is now open. The S&P could gap up or gap down huge on Monday. Take your pick. I’m a technical trader. I use support and resistance to identify where buyers and sellers may be, but when news is pending that can quickly cause buyers and sellers to change their minds, the charts become much less useful. Such is the current situation. There’s always another day and another trade. I see no reason to be all in right now. Scale back; take some money off the table. Let the dust settle first.

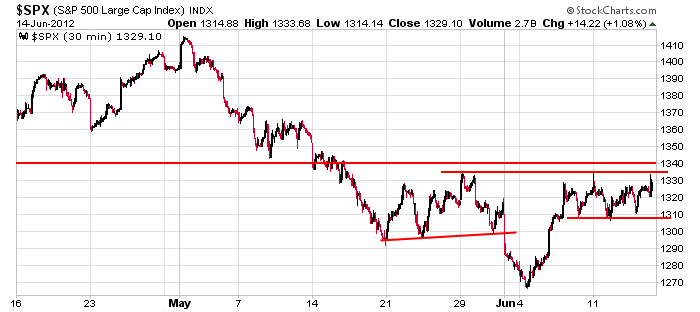

Here’s the 30-min S&P chart. The last seven days have been: up, down, up, down, up, down, up. This has given us a tight range with established support and resistance. But as stated above, support and resistance have less meaning when big news is pending. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 15)”

Leave a Reply

You must be logged in to post a comment.

If today is down, then is more likely Monday is up? Big?

no

how convenient for bama to run the reelection market up and blame it on greece

sp hits the 50dema and parks. doesnt bounce consolidate and try again. doesn’t go through.

just sets there. thats how you tell its the fed

bull its the fed

once apon a time and before the creation of time,was the majji and from the majji came the 4 quad witchs and they had little helpers called j p morgans,goldmans,deautcher, and morgan c

now these pro instos create bulls and bears out of the tiny retailers,that they like to rip of and manipulate,

but the smart retailers dont follow retailer inds,but follow insto indicators and watch for the bigfoot prints

the feds so stupid that it wont even short the market to create a bounce

no wonder my dead cats died

sold some aci amat aa. aci 6% one day

be a magican and cause the euro to rise and levertate,

be a scientologist and be cause over life ,matter energy,space and time

be a Aussie and be cause over gambleing

roo killer

Some eat roo,some eat grizelly bear,i eat roaring bulls

those long only mutual funds are easy to catch and always on the wrong side of the fence

camel are good to smoke

lol when my son was 4 I used to tell him when the steer saw us pull out the bbq, it would run and hide in the ditch

lets taker down girls daddy wants to reload

isn’t it monday the fed anounces what it will put in place of the expiring twist

tues or wed

I would cover too. looking straight into end of quarter 401k propaganda statement

anyone for some nice retailer put opts for next week as the instos sell them to you

i bet the majji instos have a plan for that

the alluminati trade

dont say options round Rich prolly still a little sore

Dumpster diving makes me sore, options make me broke.

Volume without movement means accumulation. Will Greece cod liver?

I think no squeeze means ppt

Greeks are stubborn, got 300 in their blood. Shame to let the Euro fall apart. Immediate satisfaction vs. delayed gratification. Is anybody out there?

and spartians were proud

What’s a ppt?

plunge protection team. they’re the ones that keep the market up in times of peril…

or elections

some heavy buying the up tick on my tick indicator as short cover for the week end greek default renegociations

mon should be down with ecb/imf to move to prop up markets with liquidity

china/japan to buy the euro for support

and the fed with its –tobe or not to be QE3

welcome to the casino

is sin good for the soul—no ,but one should be cause over sin–thats called responsibility

looks like yet another month Aaron doesn’t want my money