The market does two things: it trends and it chops.

Special offer for IVolatilty.com Trading Digest readers — join Leavitt Brothers for $15

A key to successfully navigating the market is to nail an occasional trending move. It’s the baseball equivalent of getting a hit when the bases are loaded vs. getting a hit when there’s no one on – you must take advantage of the opportunity. Sure you can trade in and out and make 50 cents or a dollar on each trade, but that’s hard work and it only takes one bad trade to wipe out several good ones. The essence of trading is to survive when the market is choppy and then take full advantage when the market trends.

Here’s a simple indicator that helps identify tops and bottoms and keeps you on the right side of the market for most of a trend. The goal is to ride a one-direction move and not get shaken out by noise or what would be considered a normal counter move within the trend.

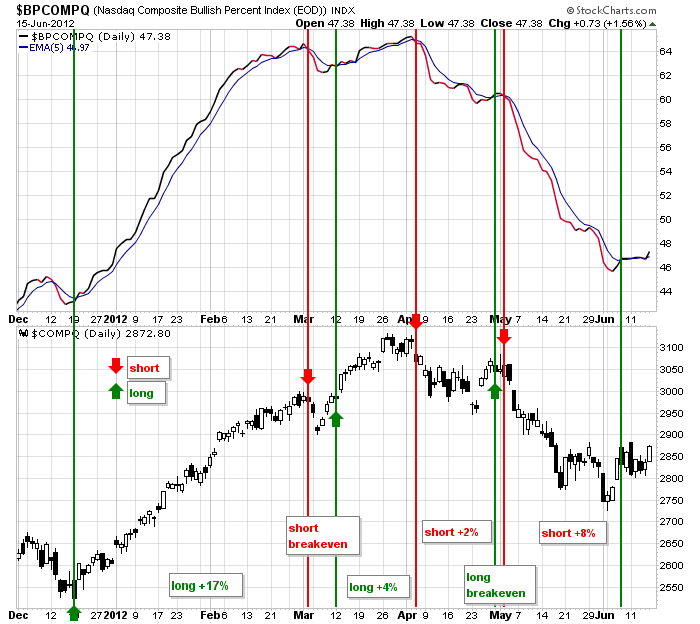

Below is a chart with two panes. The top pane is the daily Bullish % Index of the Nasdaq and its 5-day EMA. The bottom pane is the Nasdaq. A long signal (vertical green lines) is given when the Nas crosses above its 5-day, and a short signal (vertical red lines) is given when the Nas crosses below. This indicator is not perfect, but if your goal is to nail most of a trending move, this will help.

The first buy signal in Dec 2011 went for ~ 17%. Then a breakeven short was followed by a 4% long move. The next short and long netted a small gain, and then the short at the beginning of May went for 8% before a buy signal was flashed last week. Again, if your goal is to nail the bigger moves without getting shaken out by “noise,” mission accomplished. And this of course is an index, which is inherently a slow mover. If you’re wise about the stocks you trade, your returns can be much greater.