Good morning. Happy Monday. Hope you had a good weekend.

The Asian/Pacific markets closed up across the board. Australia, Hong Kong, Indonesia, Japan, South Korea and Taiwan rallied more than 1%. Europe is currently mostly up. Greece is up 4%; no other index has moved 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil is down > 1%; copper is down. Gold and silver are both down.

So the Greek elections are over. Without getting into details and naming names, the parties that wished to stay in the euro and work with the EU on a bailout won, so for now there’ll be no ripping up the old bailout, leaving the euro and re-establishing a new currency. Markets around the world can now breathe a collective sigh of relief. It doesn’t mean things are better out there, and it certainly doesn’t change any thing in spain, Italy and other struggle countries, but it does mean some uncertainty has been lifted.

The euro initially gapped up and rallied on the news but has stair-stepped down since and is now down.

Looking at the futures, I’d say the news from Greece was mostly expected and therefore a non-event. This is the ideal situation. Now the market can trade from a technical standpoint (supply, demand etc) and not be held hostage to an unknown event.

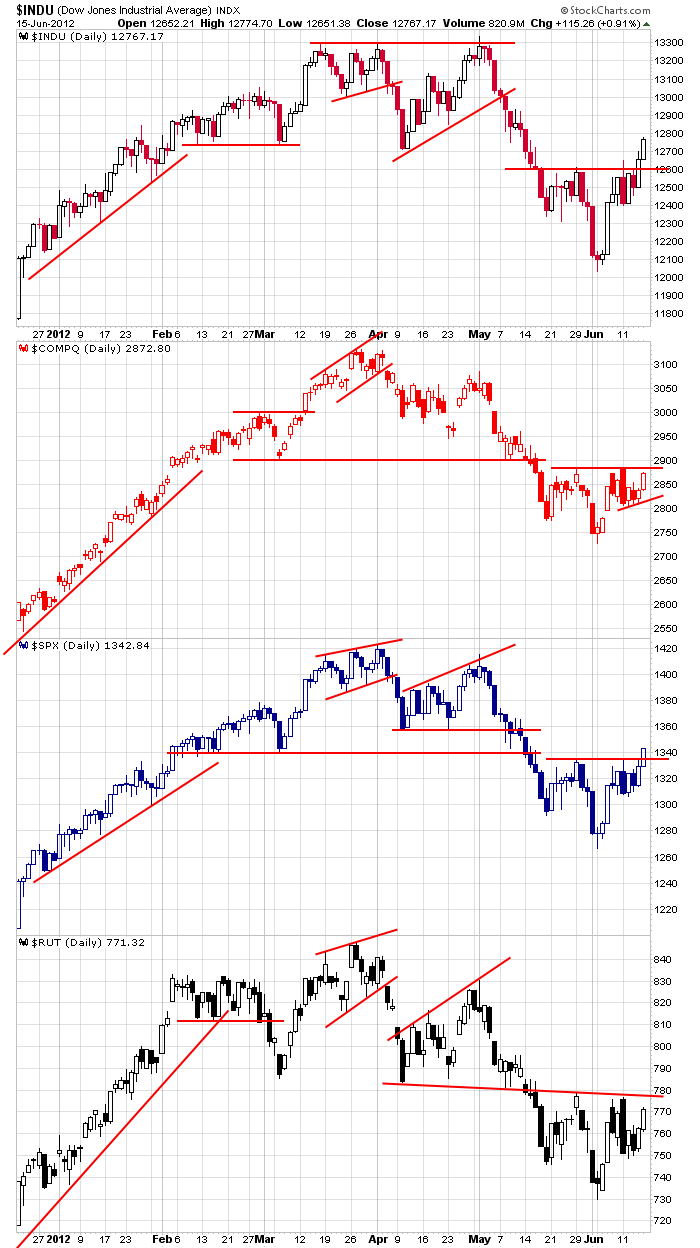

The market has just finished its best back to back up weeks in several months. The Dow and S&P are at 1-month highs. The Nas and Russell are lagging but are at the tops of their ranges. Here are the dailies…

My bias is to the upside. We could get a release of pressure today since everyone was nervous on Friday. We could also get some post-options expiration movement as traders jockey for position with the next expiration cycle. And of course there’s a FOMC meeting on Wednesday. But overall, a major item has been taken off the table and the charts have improved greatly the last couple weeks, so for now I favor the upside.

Spanish 10-year bond yields have held steady above 7% all day. Italy’s is above 6%.

Fitch lowered India’s outlook to “negative.”

Bershire Hathaway is paying $3.85 billion for a mortgage business and loan portfolio from bankrupt Residential Capital LLC. Buffett has been wrong about a housing recovery in the past. We’ll see if he has timed this purchase a little better.

Microsoft has sent out invitations to the press and industry analysts for a “major” announcement, but they didn’t say what it was.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 18)”

Leave a Reply

You must be logged in to post a comment.

microsoft are buying apple—lol

buffet has insider info that china is buying up usa properties

spanish bonds to hit 20%

the rut looks like a h/s with a retest of the neck

daytraders have more fun

they spent all weekend printing had their heart set on throwing it on the fire don’t want to put it in the vault lets party

get use to it 5 months til november

the bulls and bears cant make their mind up whos who

who would be a bear when world central banks are ready to act

who would be a bull when most soverigns are bankrupt

think ill go to the horse races

when ws cant rock the bridge that means its locked up

that means its a wave 4 corrective to ur reverse up side down small h/s, Russ

with merkell wave 5 up to the inverse h/s target

woops they might be ben benanke waves

lol we may be in the beginning of an end of qtr presidential hypnosis wave to be followed in nov by a flushing wave

but uncle been may disappoint and give us a truncated elephant wave 5 or failed h/s

I’ve been holding aci all day waiting to sell. I just sold some at 6.12 and it imediately went to 6.15 son of a b

sold some more 6.19. that feels better

These comments are getting sooo Boring…….

i agree

this 3 day 20% pop in nat gas sure put my aci in the go zone