Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. Not one index moved more than 1%. Europe is currently up across the board. Greece is up almost 4%, Austria 2%, Stockholm, Switzerland and London just under 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are up. Gold is up, silver flat.

There isn’t much important or market moving news out this morning.

Spanish 10-year yields remain above 7% while Denmark recorded a negative yield on 2-year debt.

China is contributing $43B to the IMF. Mexico, Brazil, Russia and India are pledging $10M.

Walgreens is taking a 45% stake in Alliance Boots, a pharmacy-led health and beauty group, for $6.7 billion. This means WAG is following in CVS’s footsteps.

Jamie Dimon is speaking before the House Financial Services Committee.

Microsoft’s big news yesterday was that they’re launching their own tablet. I don’t know. It seems a little too late. For years they were obsessed with Google, and Apple ran off and became the biggest company on the planet. Now they’re pivoting and focusing on Apple’s business. The problem is Microsoft has always been able to out-muscle everyone with subpar products; now quality matters a lot. The cards are stacked against them, but from a consumer standpoint, it’s nice to have another major player in the space. Besides having a great product, their biggest hurdle will be convincing app developers to develop apps for the tablet – no small feat because app developers will only develop if there is a big market.

Tomorrow of course if FOMC day. In the past nobody expected anything. Now a greater percentage of Wall St expects QE3 or at least language that suggests the Fed is standing by ready to act if needed. This sets up the market for a possible stiff sell-off if it doesn’t get what it wants.

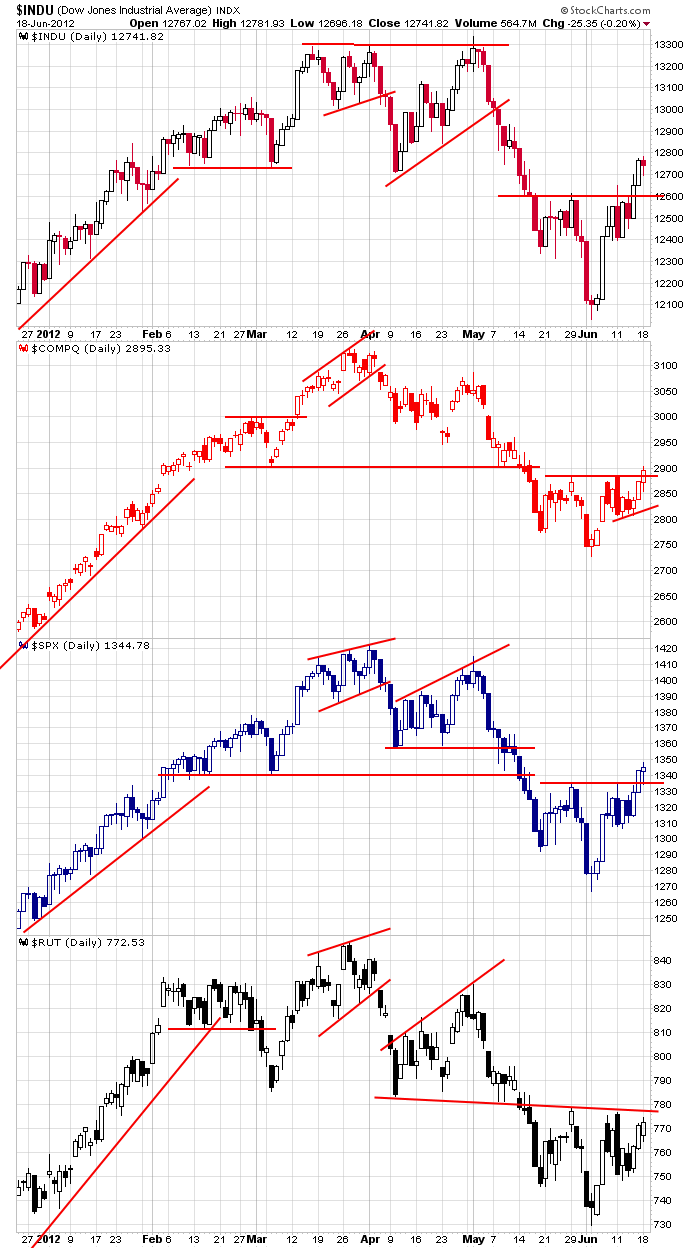

Here are the daily index charts. The Dow and S&P broke out last week. The Nas joined the party yesterday. The Russell needs to catch up.

More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 19)”

Leave a Reply

You must be logged in to post a comment.

sold some aci 6.29 pre market up 2% from yesterdays close. nat gas is down 2 1/2% from yesterdays close. I feel like sylvester that just ate tweety

natty is now down 3% and coal is starting to drop LMAO

come on baby come back to daddy I’ll take you back at 6.11 4 1/2% lower lol

3%

had to pay 6.15. this is going to be one helluva a run if we go clear to the end of the month.

skankies got that cattle prod right up your bulls ass taz

AA and AMAT up 2%. think I’ll just raise the stop

WS tried 5 or 6 times to sell it down yesterday morning and found the fed had a floor in.

apparently they decided to load up yesterday and run er up today

as a trader you cant trade on what SHOULD be happening. you have to be quick to recognize whats in front of you. dont be stubborn and keep looking for waves that aren’t there lol

sold aci again 6.29. 2 1/2% 1 hr

I cant believe congress is sooooo stupid they want to get on tv and show the world how stupid they are

sold the last aci 6.48. sp500 at 1362. will watch to see if fib retrace comes into play

bought back half of what i sold at 6.48 at 6.40 in case we retest resistance

looks like thats it taz 1362. you and little peter can measure now

you havin steak taz? or just a little horn

Gee Russ…aren’t you tired of your own voice yet ??….Boring

if you had any money you little piss ant your opinion might mean something

lol

my AMAT just jumped 2% after hrs. cnbc named it stock of the day