Good morning. Happy Monday. Hope you had a nice weekend.

After 4 consecutive up days, the market ended last week near its intraweek high and at the high of March.

The last 4-day win streak occurred in late January – the market followed with two solid down days. Before that was late December – the market stalled for two days and then got clobbered for two weeks. Before that was the move off the November low – the market followed with a nasty down day before moving up in choppy fashion for five weeks.

It’s not going to be up, up and away forever. The market is due for a little give-back…or at least some sideways consolidation.

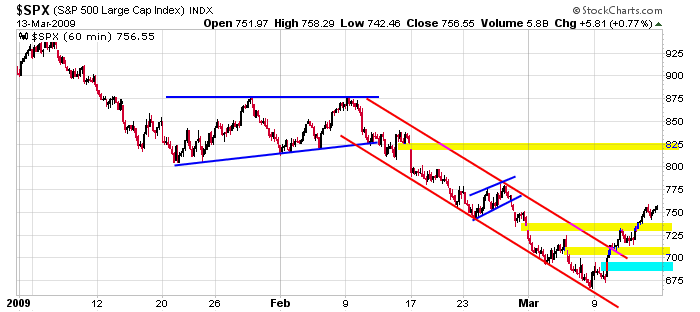

So how will the new week start? With a big gap up! Fun stuff. Here’s the 60-min SPX chart. Besides being ‘due’ for some consolidation, the index is bumping up against a block of resistance between 750 & 775 from late February.

Research this weekend didn’t reveal many very good set ups. Many stocks have rallied nicely off their lows, but like the overall market, they too need to do some backing and filling in order to provide better risk/reward entries for the next leg up. Be a little patient here. Until proven otherwise this is just a bear market rally, so unless day trading, stocks should not be chased.

Overall I think the SPX gets to 900, perhaps higher, but it won’t necessarily be a smooth ride.

More comments coming on the Market Window after the open.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases