Good morning. Happy Tuesday.

We headed into this new week with the market being a little stretched to the upside and in need of some give back, and that’s exactly what we got yesterday. After pushing to a new high midday (to sucker in new longs and cause some shorts to panic), the market sold off, filled its opening gap up and closed at its low.

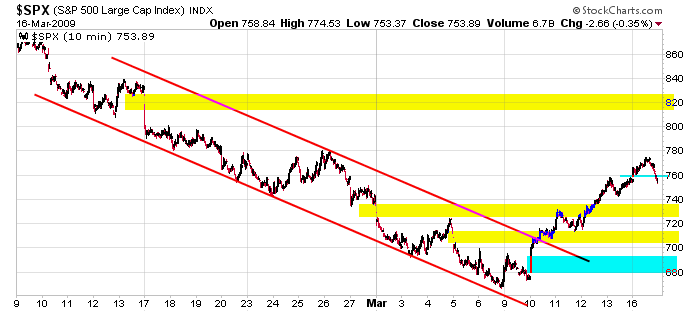

This is a very typical dynamic…the market is engineered beyond where you think it should or could go, and then it’s driven back in the other direction. Here’s an intraday SPX chart. A 25% pullback off the high would bring the index down 5 points from yesterday’s close. A 38% pullback would be another 20 points, and a 50% pullback would be 34.

Don’t fight a correction. It’s healthy and necessary for this mini uptrend to continue. The bears need to reshort (they’ll add fuel to the fire on the next leg up), and the weak longs need to sell (if prices continued up, they’d cap the upside with their profit taking…and by the way, I would be considered a semi weak long because I prefer taking some profits and rebuying over holding through a correction).

Day traders can certainly play the downside. Swing traders need to start building their buy list for the next leg up.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases