Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Indonesia and China dropped around 1%; Japan rallied 1.7%. Europe is currently mostly down. France, Germany, Stockholm, London and the Czech Republic are down more than 1%. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil is up, copper is down. Gold and silver are down.

The 27 EU heads of state are gethering in Brussels today for a 2-day summit to discuss the euro crisis. Expectations are low anything meaningful or significant will be accomplished.

The Supreme Court is expected to rule on the constitutionality of Obama’s Affordable Care Act this morning.

Rumors are the JP Morgan trading loss intially estimated at $2B may grow to $9B by the time they unwind the entire position.

Germany’s unemployment rate has moved up to 6.8%.

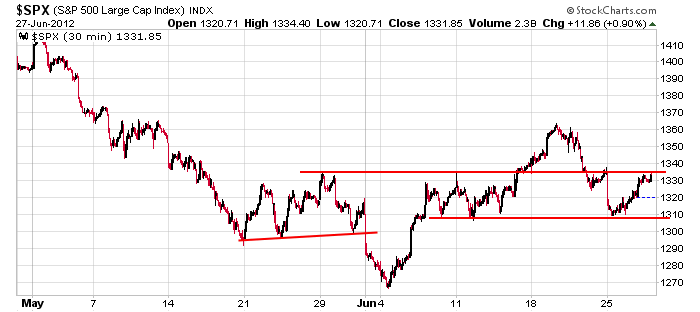

Here’s an update of the 30-min S&P chart. On Monday and Tuesday it tested a previous low and yesterday it began the process of testing a previous high. Other than a breif move down in early June and brief move up last week, the entire has traded in a 35-point range (from 1300-1335) for almost six weeks.

We had many good set ups to play during the 2+ week rally that started the month but have had to shift to a more defensive posture the last week because the charts needed to reset and the market’s movement over the near term was less clear. That’s trading – especially swing trading. We get a bunch of trades, and then we have to lay low and wait for the charts to reset. You have to be aggressive when things are going well and patient when the market needs time to rest. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open – (Jun 28)”

Leave a Reply

You must be logged in to post a comment.

bought ACI 5.95 7:30 sold it 6.20 8:00 4% 30 min.

do u buy/sell on margin

trading acct yes ira no

the ira is your pension fund ,i suppose

trading a/cs are more fun ,especially on 100 to one margin day trader rates

does ur pension fund let you buy chinesse yuan

its an ira. yes i can trade currencies and anything else i want

do you know an e broker can give you an ira acct?

its just like my trading acct except no margin and no taxes

not being a yank or irish i dont know what a ira a/c is

bought at 6.11 sold at 6.26 been in and out 4 times this morning. vol starting to slow down too bad

this big black boss bama health plan could lose the election for him

bought 6.12 sold 6.29 everytime I think no way it will come down again but it has. no way it will again today

nas broke through 200dema support interday but seems to be getting propped up like it doesn’t matter same old same old. if coal doesn’t follow nat gas down next week that would break the pattern

I posted yesterday not to take end of qtr ramp for granted this would be a good place for an ambush. well here it is. just like a lion at the water hole

next support nas 2800

looks like we hit SHIT Surprise HIdden supporT at 1313, 20 pts above obvious support at 1293.

skankie and little timmy think they’re geniuses lol

price action fells like a invisable triangle or a pos broadening triangle jaws of death

so far the june advance has been a bear trap set up by my son cheif greacy bear

and we now have a bear head/shoulders for a down to june lows

but im a daytrader and dont worry about such things

whilst i dont know my abc,but 3 plus 3 plus 3 ,equals nine and that is the life of a dead cat

just like sideways chop

sold the last ACI 6.56 same place we topped out last wed

short covering to close

God why don’t u 2 get a room !! leave this site