Good morning. Happy Friday. Today is the last day of the week, month and quarter.

The Asian/Pacific markets closed mostly up. Hong Kong and India rallied more than 2%; Australia, China, Indonesia, Japan, Singapore, South Korea and Taiwan rallied more than 1%. Europe is currely posting big, across-the-board gains. Greece is up 5.6%; Austria, Belgium, France, Germany and Stockholm are up more than 2% while Norway, Switzerland, London and the Czech Repulic are up more than 1%. Futures here in the States point towards a big gap up open for the cash market.

The euro is up more than 1%; the dollar down more than 1%. Oil is up 3.6%; copper 4.2%. Gold is up almost 2%, silver up 3.5%.

The only news that matters this morning comes from the European Summit where the bar had been set very low and expectations important and significant decisions would be made were non existent.

The 17-nation euro zone decided to allow help to troubled banks without adding directly to the sovereign debt of the coutries. This has been an issue where money given to the Spanish banks ultimately fell in the lap of the Spanish government which caused borrowing costs to climb to unsustainable levels. Now the banks can be recapitalized without without the government providing a backstop.

Also it was agreed a supervisory body would be established to oversee the continents’s banking system.

This news has been well received all over the world. As I type, S&P futures are up over 20.

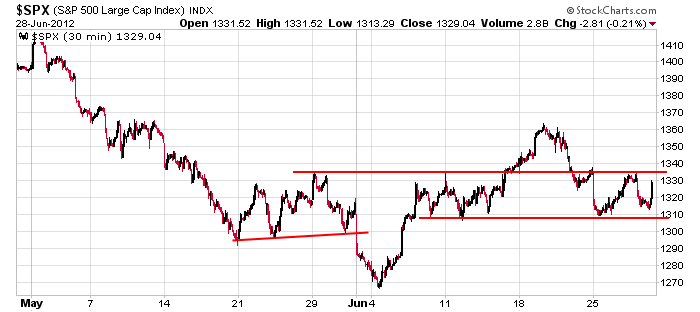

This has been a hectic week. The market gapped down big on Monday…did a little double bottom Monday and Tuesday and rallied into Wednesday’s close…a gap down and weakness followed Thursday until late in the day when the market went vertically up when news from the EU Summit leaked. Now we’re getting a big gap up. For those who were bullish all week, you’ll ultimately win but not until after two big gap downs were stomached. For those that were bearish, there were a few opportunities that brought a smile to your face, but ultimately you lost as all the indexes are set to open well above the week’s high. Here’s the 30-min S&P chart. Support was tested Monday and Tuesday, resistance Wednesday, and now were going to get a gap up to the 1350 area. Fun times.

The market has held up remarkedly well considering the state of global issues, so if major areas of concern are cleared up, from a relative strength standpoint, the indexes will be free to rally. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jun 29)”

Leave a Reply

You must be logged in to post a comment.

I guess there are a couple of things to think about Jason.

Could it be a buy the rumour sell the fact situation.

Often when futures do a huge run before the open they fade away or go sideways after the gap up open – as all the work has already been done.

I have no confidence in what is happening in Europe of the US.

The whole situation should have been allowed to crash and burn in 2007 and now we would be in a real recovery mode.

All markets, left to their own devices, find their own level.

I fear we are setting up for an almighty collapse but – at the end of the day we have to trade what is in front of us.

Forgot to mention end of financial year window dressing – everyone has to get a bonus LOL

“All markets, left to their own devices, find their own level.”

that was a long time ago before we had a walrus

this world now is all about government deception. gotta make that eoq 401k statement look pretty. everythings fine.

but why is AussieJAY squealing being bent over that log?

AussieJay obviously wants tech analysie of futures indexs and no jokes or bad spelling

well i have to do something to keep me awake on lonly assie nite time,whilst waiting for a day trade set up after europe has finished

t/a –this is obstensibly a abc up correction to a impulsive down we had

now corections are choppy overlap and take time to unwind the pervious impulsve fast move

now that can be Gann analysis or just common sence

i agree with what Elizabeth said,but think we need more time to unwind

when the whole world realizes that there simply is not enough money in the world to pay the massive world debt and someone will have to take their margin call hit—now thats fundermentals for u

high noon is usually quite –i will shut up and watch a movie and wait

A relief rally to celebrate the fact that the conference has made an affirmative action on anything rather than the usual……

So the world is saved?

usd is way down today off a double top that is resistance from 2010. so yes there is a very good chance the bottom of the stock market is in.

there also was a good bid for coal and steel after hrs

interesting week next week to try and discern between backing, filling and consolidation

and follow through. euro is the key

Well next week will be interesting – a double top under a top and a retracement to the .382 fib level of the last run down from the last top – for all your techies.

For me – I say you have to trade what is in front of you but I’m not confident for a lot more upside.

The whole situation is stuffed. Europe and the USA are basket cases. End of FY window dressing, too much debt, world economy slowing – even India and above all the almighty China – who is going to buy all their “stuff” now and not much coming out of the USA this week that is good but we will have to see what the non farm payrolls bring late next week.

Even Germany’s output has slowed as a response.

QEIII – well even the Titanic was never supposed to sink. QE I & II didn’t manage to save the situation – only made it worse if the truth be known.

We live in interesting times. LOL