Good morning. Happy Thursday.

First off, Leavitt Brothers is now offering a FREE TRIAL. Go here to sign up.

emini traders -> today is rollover day. Start trading the June contract.

I had a thought yesterday that I wrote about in daily report that I’ll repeat here. It seems everyone and their brother thinks a bottom is in place and a rally is underway. Even the bears admit there may be some upside. Is it possible for everyone to be right? Not sure. Let’s just say I wouldn’t be surprised to see this first rally attempt fail. Then possibly some downward movement into options expiration (we can’t let those put buyers make bank, can we?). Then the real rally can begin. This isn’t a prediction. I’m just thinking out loud. There are already way too many bulls out there.

The S&P closed up yesterday – first time for consecutive up days in a month.

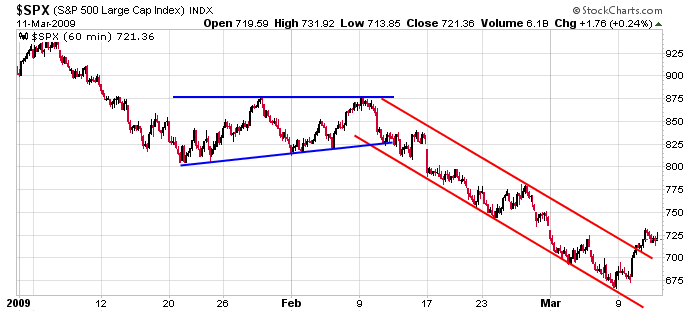

The action of late has been encouraging, but the market is far from being “in the clear.” That means it hasn’t separated itself enough from resistance and is therefore still vulnerable to giving back much of its gains and falling back into its pattern. Here’s the 60-min chart…

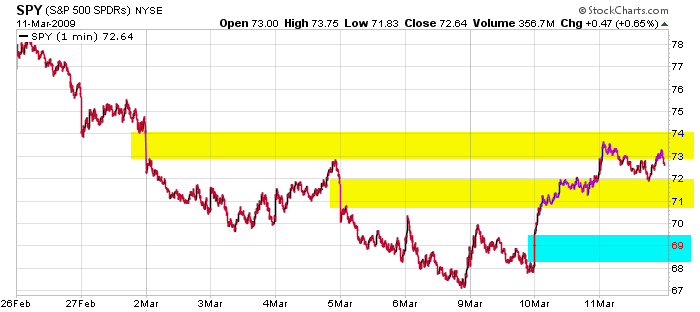

So far, so good but not exactly an uptrend. Here’s the 1-min chart over the last 10 days. The market traded into its second gap but couldn’t hold the level. I’m not predicting Tuesday’s gap will fill but I will say the market is fragile enough that any stalling or hesitation here increases the odds it’ll fill.

My bias remains to the upside, but I’m not going “all in.” The market has some proving to do.

headlines at Yahoo Finance

stocks to watch from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases