Good morning. Happy Wednesday.

First off, Leavitt Brothers is now offering a FREE TRIAL. Go here to sign up.

Ok, the market rallied huge yesterday. It was easily the best up day in a long time. The question is whether a bottom has been put in place. My answer is yes. That doesn’t mean we’ll gap up and rally hard again – we may get some backing and filling – but yeah, I think it’s safe to say a bottom – for now – is in. My bias is to the long side.

Instead of getting a total washout, the market grinded its way to a bottom, and when enough people were just flat tired, exhausted and at wits-end, it bounced.

I’ve said numerous times over the last few weeks that at these levels the charts didn’t matter; the technical indicators didn’t matter. When the market is falling as consistently as it was, emotions, sentiment and supply & demand matter more. Now that we’re moving up, I’m going to stick with this same statement. Yes previous support levels can be resistance on the way up, but short-interest and the anxiety related to possibly missing the bottom matter more.

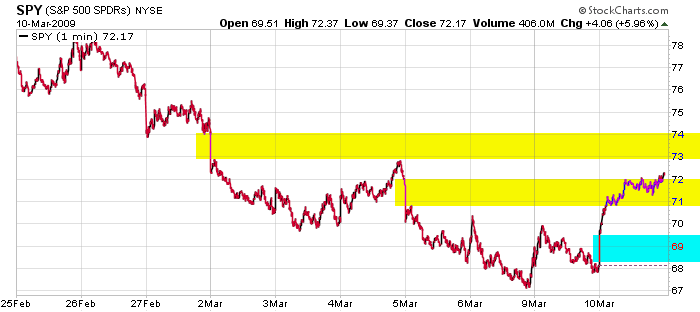

Here’s the SPY 1-min chart over the last 10 days. The first gap has filled, but we now of course have a downside gap. The next target is 74 which approx. corresponds with SPX 740.

My bias is to the upside…I’m only playing the upside. Hopefully this move has legs for a couple months.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases