Good morning. Happy Tuesday.

The Asian/Pacific markets closed mixed. India and Singapore rallied more than 1%. Europe is currently mostly up. Austria, France, Germany, Amsterdam and Norway are up 1% or more. Futures here in the States point towards a positive open for the cash market.

The dollar is flat. Oil and copper are down. Gold and silver are up.

Alcoa (AA) kicked off earnings season yesterday by beating expectations. The CEO said: “Although aluminum prices are down, the fundamentals of the aluminum market remain sound with strong demand and tight supply.”

European governments are spending about $123B to recapitalize Spain’s banks.

Scranton, PA (Pennsylvania’s 6th most populous city) is basically bankrupt. It cut all 400 city employees salaries to minimum wage because it only has $5K in the bank. Things are going to get messy out there.

Other news out is, in my opinion, random noise.

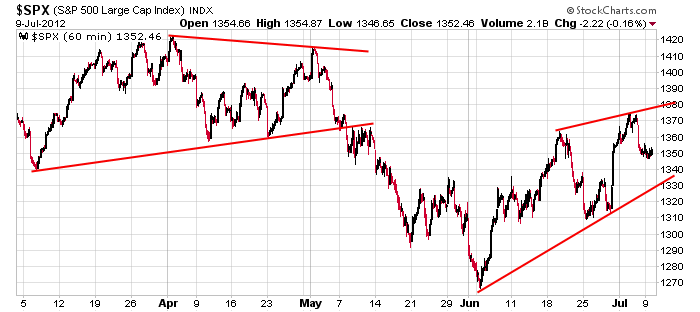

Here’s the 60-min S&P chart. The index moved in a range during March and April…then it sold off fairly hard in May…and since it has been moving up, but the movement hasn’t been smooth. There have been lots of big gaps, several sudden reversals and several sudden moves. And for what it’s worth, last week’s high coincided closely with support from the end of April and beginning of May.

I would consider the market to be in decent shape right now…not great shape, just decent shape. It has absorbed a lot of negative news recently, so it’s had an excuse to break down but it hasn’t. Instead it’s held up. This is a good sign. If the negative news flow can turn positive, I have little doubt the market can rally, but that’s a big if. The market always has to deal with news in the States and abroad, but the news currently having to be digested has the ability to move prices quickly in either direction. Because of this we need to be defensive with our trades. That means smaller position sizes and satisfaction with taking smaller profits. You definitely don’t want to let a profit turn into a loss or a small loss into a big loss. Swing for singles and doubles. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 10)”

Leave a Reply

You must be logged in to post a comment.

Out of the prior up channel in a flag. Maybe, but Momma would say stay humble.

the fed seems to have the support of the big instos at least into earnings

after all what would you expect the bankrupt banks to do into their earnings

the ponsi goes on –maybe

a period of intense volitility–yummy

http://stockcharts.com/h-sc/ui?s=$SOX&p=D&yr=1&mn=0&dy=0&id=p95262462501&a=44640932&listNum=2

AMAT dropped 6% pre market on its warning. since has bounced back 4 1/2%.

market smells like the shithouse door on a tuna boat