Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed; there were no 1% movers. Europe is currently mostly down; there are no 1% movers there either. Futures here in the States point towards an up open for the cash market.

The dollar is down. Oil is up; copper is flat. Gold and silver are up.

Spain is hiking their VAT (value added tax) from 18% to 21% on Aug 1 and is cutting spending to slash 65 billion euros from their budget deficit by 2014. Hmmmm, I’m not so sure austerity is the answer.

Germany sold 10-year bonds at 1.31% – the country’s lowest yield ever.

FOMC minutes comes out at 2 pm EST – Wall St. will be looking for hints the committee is leaning towards more monetary stimulus.

Alcoa beat earnings expectations on Monday and then fell 4.1% yesterday – not a great sign.

PFGBest has been accused of misappropriating customer funds for more than two years. If regulators want this to stop, they gotta throw a bunch of people in jail.

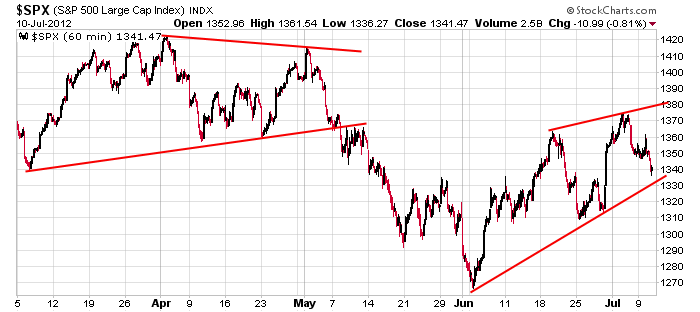

Here’s the 60-min S&P chart. A symmetrical triangle resolved down in May, and now we have a rising wedge and a four-day losing streak – the longest since mid May. Last week I said the bulls had a cushion to work with. That cushion is gone. What would be considered a normal counter move within an uptrend has taken place, so if the bulls wish to continue the uptrend which has been in place for almost six weeks, it’s time to step up and defend their turf.

MAR has earnings today after the close. GOOG tomorrow. JPM and WFC Friday. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 11)”

Leave a Reply

You must be logged in to post a comment.

C’mon let’s kick it ALL further down the Road !……..

Jason,

Re: Hmmmmmmmmmmmm

Austerity or opulence both just fix the flat and neither guarantees the engine will keep running. Austerity distributes wealth from the poor to the rich. Opulence dampens the incentive to work. Give a man a fish or teach him how to fish? Who pays for the fish and who pays for the fishing lessons?

I was reading about the Bubonic plague and it struck me this Debt/Credit crisis is a plague. The plague killed 50% of the population then wages rose and the economy got better. Austerity, opulence or plague?

It’s strange. during the 1930s depression we also had a huge drought which caused the dust bowl. we have a drought again now. hope the myans aren’t correct

we’re going lower, but they’re sure dragging it out. better for the world I guess/hope

i dont think the bulls and bears know what they are doing and maybe in a state of confussion till 2nd week of earnings

good for daytraders–the backbone of the market

you probably dont see this market is being propped up. it goes with the statement release to show the civilians ws approves what the fed is doing and everything is fine.

I think I just hit on it.

You guys ARE civilians

i am a alien civilian

I’ll need a confirming indicator before I’ll believe that.

my tick indicator is the only reliable part of the market–both 2 and 5 min ticks

buy a tick–sell a tick