Good morning. Happy Thursday.

First off, Leavitt Brothers is now offering a FREE TRIAL. Go here to sign up.

Now on to the market. Yesterday’s action was enough to put me mostly in cash. As is, I had been scaling out of shorts – many of which I had been in for several weeks and had big profits in. And I had started building my long list, but the late-day sell-off made me pause. So now I sit here mostly in cash and not really sure what comes next.

The overall trend is down, and I’m sticking with my SPX 600 price target I established last year (it appears many have joined me in expecting 600 and some have leapfrogged me and expect 500 to be hit). I know the market will turn before the economy turns, but I think there’s still enough fluff out there to justify much more downside. But this doesn’t mean I’m going to short and turn my computer off for the next year. I’ll still poke a few longs on the bounces and re-enter shorts at higher levels. Heck, I’d prefer lots of up and down movement.

It is said strong markets embrace good news and ignore bad news. I’m not sure what bad news hit the market today, but the futures market is indicating a sizeable gap down – one that will open the indexes near yesterday’s lows. This will be a good test. If the market can shrug off the negativity and close up on the day, odds increase a short term bottom has been put in place.

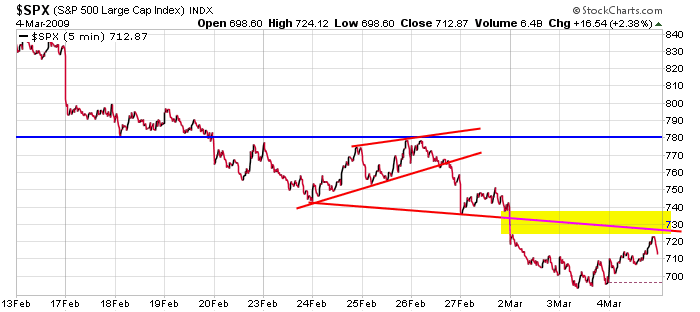

Here’s 13-day, 5-min chart I posted yesterday. The SPX got rejected by the bottom of Monday’s gap down and a trendline connecting two previous lows.

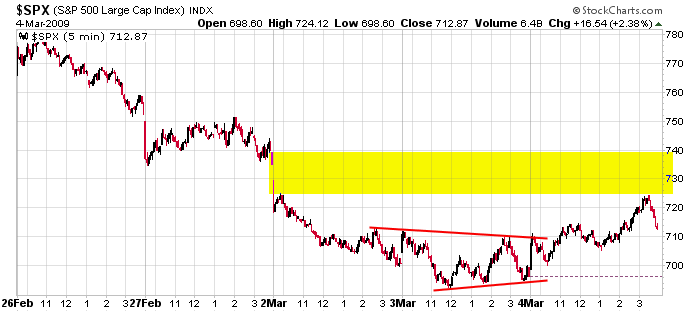

Here’s a close-up.

Whether the market can shake off the down open or not will go a long way dictating what kind of bounce we get…if we get a bounce.

headlines at Yahoo Finance

movers & shakers from MarketWatch

today’s upgrades/downgrades

this week’s earnings & economic releases