Good morning. Happy Wednesday.

First off, Leavitt Brothers is now offering a FREE TRIAL. Go here to sign up.

Now on to the market. Here we go again. The market will attempt to gap itself out of a hole – not a good foundation to rally from. But I do think we’re getting closer to a bottom – it won’t be THE bottom, but it’ll be a tradable bottom. For a couple days now I’ve been saying it’s too late to go short but too early to go long. Instead managing what we had and getting ready to go long was the best use of our time. We’re almost there. Our patience will soon pay off.

I’m also sticking with what I’ve said the last two days regarding the usefulness of the charts. I don’t think they’re useful. I don’t think they’re helpful. I’m not a big fan of drawing a line from 10 or 15 years ago and saying: “that’s it; that’s long term support; if that can hold etc etc” Bottoms are put in place when emotions run high, not when a certain level holds or technical indicator turns up. In fact technical indicators often stop working at the extremes. They may be obvious after the fact, but never in the heat of battle.

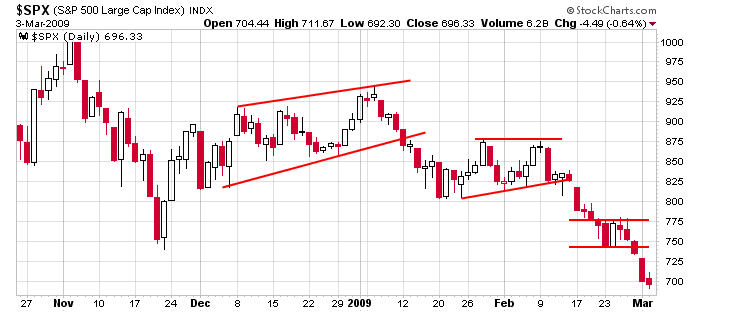

Here’s the SPX daily chart to put in perspective the downtrend we’ve been in since the first week in Feb. All those patterns will be resistance on the way up.

When the market does bottom, this is what I’ll be looking for. First we’ll get a violent move up – volume will be huge and the SPX will rally 100 in just a couple days. Then the market will take some time off to drift sideways and do a little backing and filling. Then it’ll breakout and begin another leg up. It’s that second leg up that somewhat confirms a temporary bottom is in place.

Lot’s of money to be made right now. Be ready.

headlines at Yahoo Finance

stocks to watch MarketWatch

upgrades/downgrades

earnings & economic releases