Good morning. Happy Wednsday.

The Asian/Pacific markets closed mixed, but the losers lost more than the winners. Hong Kong, South Korea and Taiwan each dropped more than 1%. Europe is currently mostly up, but only Greece (up 1.2%) has moved more than 1% from its unchanged level. Futures here in the States point towards a down open for the cash market.

The dollar is down. Oil can copper are down. Gold and silver are down.

Today we get round 2 of Bernanke speaking/testifying on Capital Hill. Yesterday Bernanke didn’t hint the Fed was planning on doing anything but he repeated that the Fed “is prepared to take further action as appropriate to promote stronger economic recovery.” Goldman Sachs says they expect the Fed to ease a small amount at the August or September meeting and take a bigger step in early 2013 after the election. I don’t know what they’d ease.

Greece leaders were not able to identify the 11.7 billion euros worth of austerity cuts for 2013 and 2014 that was necessary to received the latest rescue package. They’ll meet again next week.

INTC and YHOO had earnings after yesterday’s close. INTC cut its full year revenue forecast. Both are down premarket.

BAC reported better-than-expected earnings this morning. The stock is flat before the open.

AXP, IBM, QCOM and EBAY report after the close.

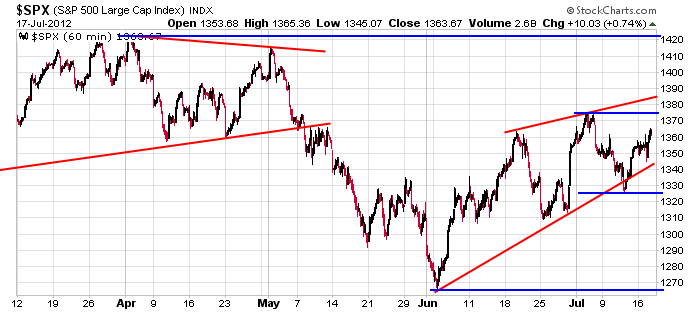

Here’s an update of the S&P daily chart. Higher highs and higher lows since the beginning of June remain in place. And considering last Friday’s big rally came on weak volume, it was nice to see follow through yesterday. Although I lean to the upside (because I have many more good long set ups than short set ups), I’m still being defensive. That means smaller position sizes and being quicker to take profits. I’m shooting for singles and an occasional double. No home runs right now. There are still too many headwinds. The condition of the market dictates our trading style. Don’t fight it. You can’t trade the same way month after month. You have to slightly alter your style based on what the market is offering.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 18)”

Leave a Reply

You must be logged in to post a comment.

Jason good post speaking about traders needing to be quick to evolve to what the market gives.

not what one thinks it SHOULD do.

the ws wolves are preying on the undecided reactionists.

Ease as in, “Ease on down the road”. They’re going to, “ease” the can on down the road.

some shorts are afraid the feds packin a wad a cash and intend to play. coal and nat gas up 5%

sold some aci 6.17. incredible

Arch coal up 6% today. remember this ML and BMO

http://www.marketwatch.com/story/alpha-natural-resources-and-arch-coal-shares-fall-after-analyst-cuts-ratings-2012-07-18?siteid=bigcharts&dist=bigcharts

our politicians are so stupid it’s embarrassing. contemplating moving to canada

ACI closed the gap and up against 6.25 resistance for the third time.

exp wed is a weird phenomenon

http://bigcharts.marketwatch.com/quickchart/quickchart.asp?symb=Aci&insttype=&freq=7&show=&time=18

INTC up 3.5% on lowered guidence yesterday. this could be the fed doing a little shopping/propping

bought a little aci @6.06 in case they try a fakeout breakout @6.28

see chanos rip into HP? awesome!

Yep, looks like HP is a long term short. My IT contact says he only buys Xerox printer no more HP printers, “Their printers are junk!”.

this last attempt up weak k then lets go down. another great trading day 2day

margaritas and steak on me girls

Steak and Margarita body shots on you? I think I just became a Vegetarian.

thought your appreciation of 7 of 9 meant you were a male. thats what I get for assuming lol

Are the body shots on you or Ryan?

I’m buying the drinks. the shots on 7 would cost more than I will ever have I’m sure

Did you ask Ms. Ryan?

you watching cnbc? mandy looks like a whore trying to keep up with the young new hires.

I miss erin and mellisa

My sidewalk is more interesting than CNBC, waiting for shooters. Besides I’m a daytrader, that stuff’s for position traders.

this courtney reagans a hot little shit

im a android and i dont discuss such things

but i miss erin and mellisa to0000

infact i miss cnbc

being in the oz outback we dont get cnbc anymore

today is ground hog day–the normal pump up for these particular after hours earnings reports

then the big sell off–well for a day or so

http://www.cnbc.com/id/30093288/

fed says propping the market up gives investors confidence

i cant read write or do arithmatic—but i like t.v

walrus and little timmy butfuk the shorts and get the cow up 100. bfd

ESu12 5m5d: This is starting to look like an ABC, volume has increased.

The EURO has a knee-jerk climb, volume fishy, I’m still short the ES.

but what comes after c

My stop.

h/s possibility

http://stockcharts.com/h-sc/ui?s=$COMPQ&p=D&yr=0&mn=11&dy=0&id=p17036606078&a=77837455&listNum=2

I see Mariano Rivera rang the NYSE opening bell on Tuesday.. shouldn’t it have been the closing bell?