Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

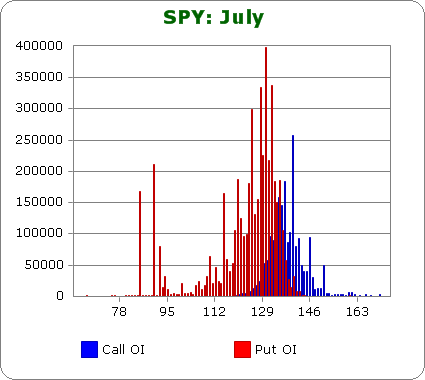

SPY (closed 136.36)

Puts out-number calls 2.3-to-1.0 – more bearish than last month.

Call OI is highest between 132 and 142, and there’s a big spike at 140.

Put OI is highest between 119 and 136 with the biggest spikes ocurring at 125, 128, 130 and 132.

There’s overlap between 132 and 136, but since puts far out-number calls, a close in the upper half of the range would cause the most pain. Today’s close was at 136.36 – right at the top. Any higher and the profits of the call buyers will start to add up. To achieve max pain or something close, flat or slightly down movement the rest of the week is needed. .

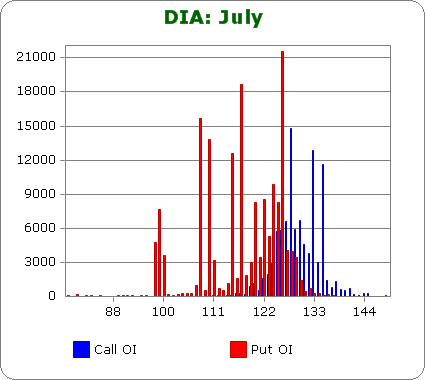

DIA (closed 127.82)

Puts out-number calls 1.6-to-1.0 – more bearish than last month.

Call OI is highest at 128, 133 and 135.

Put OI is highest at 108, 110, 115, 117 and 126.

Put and call open-interest is almost always sporadic for DIA, and this month is no differnt. But at least there’s a pretty clear line that divides most of the activity. A close somewhere between 126 and 128 would cause all the high spikes mentioned above to be worthless as of Friday’s close. Today’s close was at 127.82 – exactly where it needs to be. Flat trading is needed to cause max pain.

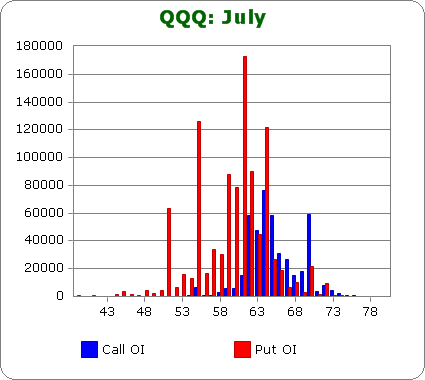

QQQ (closed 63.53)

Puts out-number calls 2.2-to-1.0 – same as last month.

Call OI is highest between 62 and 65, and there’s a spike at 70.

Put OI is highest between 59 and 64, and there’s a spike down at 55.

There’s overlap between 62 and 64, so if we get a close right in the middle, both call and put buyers will feel a lot of pain. A close in the upper half of the range would be even better. Today’s close was at 63.53 – within the range and closer to the upper end. That’s perfect because there’s a put OI spike at 64 and puts out-number calls better than 2-to-1. Flat or slightly down movement the rest of the week will cause the most pain.

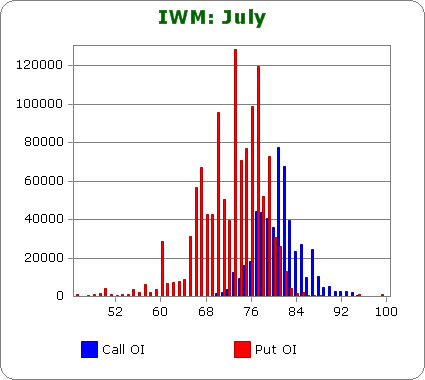

IWM (closed 79.73)

Puts out-number calls 2.4-to-1.0 – more bearish than last month.

Call OI is highest between 77 and 83 with 81 and 82 being noticeably higher than the others.

Put OI is highest between 73 and 79, and then there are spikes down at 66, 67 and 70.

There’s overlap between 77 and 79, and a close somewhere in the range – preferably near the top of the range – would cause the most pain. Today’s close was at 79.73 – above the top of the range. Flat trading would cause lost of pain, but a slight move down would cause more.

Overall Conclusion:For the most part the market is already positioned to cause the most pain among call and put buyers. For SPY, QQQ and IWM, the ETFs that have volume, flat or slightly down movement is needed. With Bernanke still to speak tomorrow and many more earnings reports still to be released this week, there’s no guarantee this will happen, but odds favor it. That’s because the market spends more time grinding sideways than trending.

0 thoughts on “Using Put/Call Open-Interest to Predict the Rest of the Week”

Leave a Reply

You must be logged in to post a comment.

The odds again favour the bookmakers,fueled by the greed and fear of the punters