Good morning. Happy Wednesday.

The Asian/Pacific markets closed mostly down; Japan and South Korea dropped more than 1%. Europe is currently mostly up; France and Germany are up 1%. Futures here in the States point towards a gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

AAPL missed earnings estimates…the stock is down almost 5% premarket.

Also down are NFLX (down 18%), TRIP (14%), BWLD (11%) and RFMD (9%).

RVBD is the big winner (up 25%). ARMH, SYMC and BRCM are also up nicely.

Ford reported a 57% profit drop, but the stock is unchanged in premarket trading. The stock has already sold off a lot lately, so the numbers are likely factored in.

CAT report strong numbers…the stock is up 3.4% before the open.

Rumors are there are conversations within the Fed about increased easing measures possibly taking place at the Aug or Sept meetings.

German business conditions declined for the third straight month, but 30-year note yields fell to a record low on strong demand.

Spanish bond yields moved down slightly.

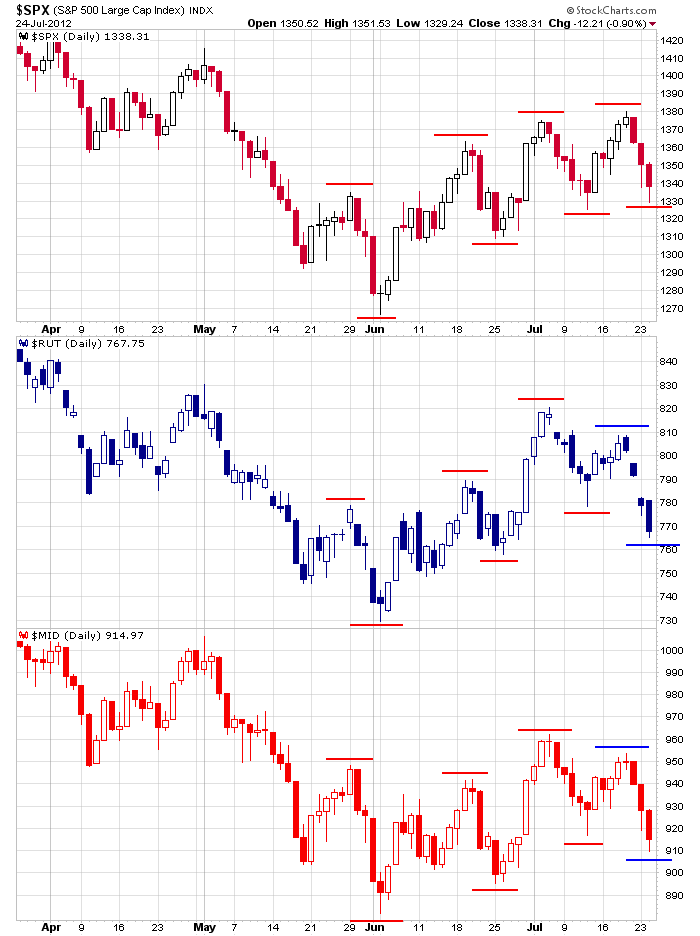

I’ve said it numerous times, I’ll say it again. I don’t like this market. Economic numbers are getting weaker, many companies have reported worse numbers than last quarter and last year and have warned about the declining conditions, sentiment is getting worse and of course the deteriorating technical picture. Many divergences have formed…between the S&P and other indexes (vs. the small caps and mid caps), between the S&P and some key groups (such as the banks, semis, transports, copper), and between the S&P and key stocks (such as FCX, GE)

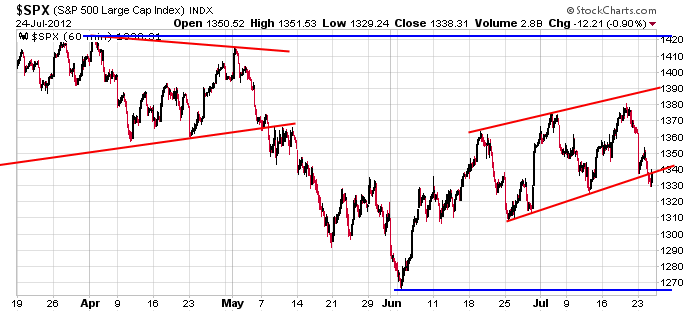

Here’s the 60-min S&P. Overall it looks neutral. It broke down from a topping pattern, and after a stiff 1-month sell-off, moved up and traded into a rising wedge. It’s not in great shape or terrible shape.

But when compared to the Russell 2000 small caps and the S&P 400 mid caps, we learn money is flowing out of the smaller growth companies and into the larger safe havens – exactly what we don’t want to see.

Conserve capital. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 25)”

Leave a Reply

You must be logged in to post a comment.

Whilst we wait on Mr Bernank to throw some more Bananas, we slip on a Greece monkey…..

PAMPLONA, Spain “Bulls run backwards”

You give peanuts to a monkey and what do you get —a banana republic

bought some ACI 5.27

sold some 5.40

2 1/2% 5 min.

the 3 pt break of 200ema support at 2843 could very well be a fakeout.

we’ll see when it retests as resistance. we are pretty oversold

as I suspected quack 200 holds deceitful ws bastards would cut your grandmas throat for a ten dollar bill

sox is up against resistance again at 370 but this time we have positive divergence

in place. also see a bunch of waves in the sp500 I named them 1 – 4 choppy waves lol

wondering if the tops in for nat gas down 3% today

nat g storage # released tomorrow

I fear little peter and the other wino have drowned… or fallen into

a black hole. please take a moment of silence

http://www.youtube.com/watch?v=wS7CZIJVxFY