Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. India (down 1.2%) was the only 1% mover. Europe is currently up across the board. France is up 2.9%, Austria, Germany, Amsterdam, Norway, Stockholm, Switzerland, London and the Czech Republic are all up more than 1%. Futures here in the States point towards a huge gap up open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

So are we going to get a repeat of the last two weeks? Two weeks ago the market was down all week until it rallied huge on Friday. Last week the market was up all week until a stiff down day Friday. Now the market has been very weak all week, and the S&P is set to gap up over 15 points. We’ll see. As I’ve said a gazillion times, in today’s market you cannot wait for a trail stop to take you out. Instead you need to be ahead of the curve preemptively taking profits.

ECB President Mario Drughi says the ECB is ready to do whatever it takes to preserve the euro.

Spanish 10-year yields dropped under 7%.

ZNGA is getting clobbered (down 40%) after missing on earnings.

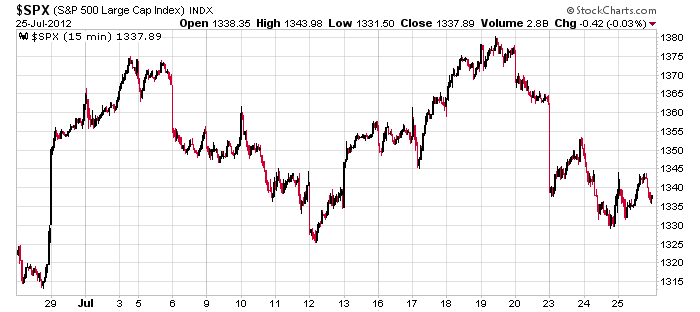

Here’s the S&P over the last month. Looks very neutral. Up, down, up, down…several mini trends but serveral sudden reversals too. In my opinion, the S&P is capable of masking what’s going on under the hood. You’d probably guess most stocks are churning in place, but that’s not the case. Many have taken big hits. Kind of makes you wonder what kind of math their using to calculate this curve because I don’t think it’s reflective of what’s been going on.

Stocks that are up in premarket trading -> WDC, AKAM, STX, FTNT, WFM, CROX, OVTI, SPRD, MRVL, UNTD

Stocks that are down in premarket trading -> ZNGA, QSII, SYNC, APOL, GRPN, FB, HZNP, GLUU

I’m sticking with my defensive conservative nature until either 1) some of the headwinds are dealt with or 2) the charts clean themselves up. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 26)”

Leave a Reply

You must be logged in to post a comment.

Jason,

If you were an institutional trader where would you invest and I think you’d have to think globally.

If you thought the Globe was going into a recession because China is slowing down (nobody can afford their stuff), the EU will always be dysfunctional socialists, and the US elected are dysfunctional where would you invest?

If you thought the Globe was going to live in uncorrupted capitalist harmony where would you invest?

I daytrade the ES. I don’t mind going backwards so I can go forwards.

teddy and scary bear gave me a wave

now weak ,blind bull is giving a counter trend,dead cat wave back

sox rejected at the 4 month downtrend line from the high made in april

1st attempt since being rejected a month ago.

make the market show you if it can get through

ACI reports tomorrow morning

the feb report dropped it from 15.00 to 10.00

the may report dropped it from 10.00 to 5.00

this is where we are right now

scared shorts are rocket fuel. the trick is to get em runnin

mission acomplised bought 5.20 thur close sold 5.85 fri pre open

should make some money when market opens