Good morning. Happy Friday.

The Asian/Pacific markets closed mostly up. Hong Kong, South Korea, Indonesia and Taiwan rallied more than 2%. Australia, India and Japan rallied more than 1%. Europe is currently up across the board. Austria and France are up more than 1%. Futures here in the States point towards a gap up open for the cash market.

The dollar is down slightly. Oil and copper are up. Gold and silver are up.

Yesterday ECB President Mario Drughi said the ECB is ready to do whatever it takes to preserve the euro. Today Germany echoed the comments – to do all in its power to ensure survival of the euro.

Spanish unemployment hit a new record high.

Let’s see…ZNGA dropped 40% yesterday and is at a new all-time low (80% off its high from just a couple months ago). GRPN is sitting at a new low (75%) off its February high. FB will open at a new low today (almost 50% off its IPO high of just 10 weeks ago). This doesn’t seem any different than the dot com bubble burting…except that there are many less companies now.

Apple is buying Authen Tec, which makes a fingerprint sensor chop used in computers.

moving up premarket -> BCOR, DECK, EXPE, PWER, SIMO, QLIK, INFA, AMGN, VTSS, QSII, N, RNF

moving down premarket -> NTGR, APKT, CSTR, WOOF, HZNP, FB, SBUX, CERN, NTSP, QLGC, GDOT, FBHS, SPN, NEM

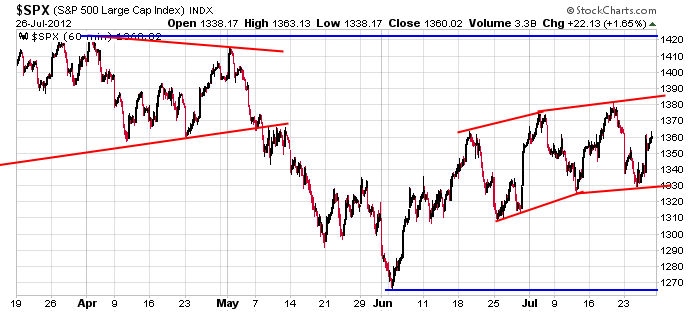

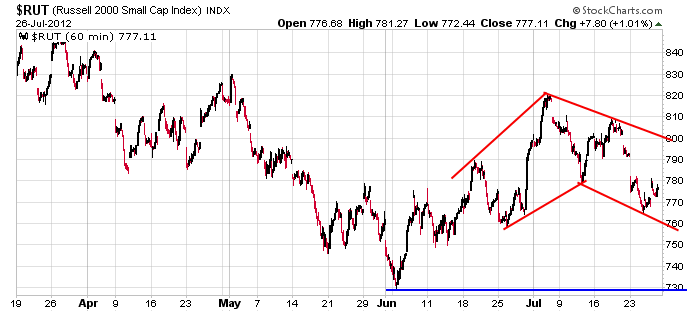

There are many things go be concerned about. As a technical trader who tries to keep things simple and not fight the trend, this is the one that concerns me most – the divergence between the small and large caps, or more specifically between the Russell 2000 and the S&P 500. The S&P doesn’t look too bad – up, down, up, down and after six weeks the index is unchanged. The Russell on the other hand has not matched the most recent higher high and higher low. Instead it made a lower high and lower low. When money does not flow into the smaller speculative issues, a warning is flashed.

Be careful out there. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Jul 27)”

Leave a Reply

You must be logged in to post a comment.

sold some of the ACI I bought at yesterdays close at 5.20 for 6.10 pre market

should make some money at the open hope it pulls back first as usual

what was ryans #?

bought some ACI back 5.93 its still pre market for Gods sake

God bless america

One would be suprised just how much markets follow the euro

and so easy it is for china or the imf to move move the euro

be a daytrader and gamble 24 hours a day

usd 2 yr high and I don’t smoke pot anymore

buy camel –smoke fags

trading in 2 accts buying in the 50s and selling in the 90s repeatedly just as hoped

what a ride

I don’t care about dividends but its funny to watch them

dumb bastards pay a 20 cent premium to get a .03 dividend

AA pays .03 to holders of aug 3rd

ACI pays .03 2 hldrs of aug 31st

we won our semi final city softball tourny game tues and at the pizza place afterwards I asked the center feilder what he and the left feilder talked about out there.

without hesitation Matt says Terry asks me how many outs there are and I tell him I don’t know.

LOL its been a good week

we should drink champagne today in rememberance of little peter

and the wino being swept into the black hole by the

evil Count Wavula. heres to you girls

…so quacks neckline holds and the sox are right at the upper downtrend line.

so I’m canging my name to Rich taz and I’m going to sit and stare out the window

at the sidewalk and suck on a camels butt. you zombies go get back in bed

bought ACI 5.72 sold 5.95. Another 4% in 15 min

sold some aci out of my ira 6.24. couldn’t refuse 20% gain overnight

bought 6.08 sold 6.42 another 5 1/2% 20 min

http://www.chartoftheday.com/20120727.htm?A

jim cramer

http://www.flickr.com/photos/d_lee/456041090/

go the instos that just managed some extreme stop running on all indexes

the big bank instos can now let the markets fall with all the shorts out and weekly index opts handled

yesterday on marketwatch, a cramer co.

Stifel Nicolaus downgraded shares of Arch Coal, ACI from a buy rating to a hold rating.

today its up 30%… in one day

camer is a monkeys ass

smalls hold

http://stockcharts.com/h-sc/ui?c=$sml,uu%5bw,a%5ddeclyiay%5bdd%5d%5bpb50!b200!f%5d%5bvc60%5d%5bilb5!lh8,3!li14,3!la12,26,9!ll14%5d%5bj61238366,y%5d&listNum=4

http://stockcharts.com/h-sc/ui?c=$sml,uu%5Bw,a%5Ddeclyiay%5Bdd%5D%5Bpb50!b200!f%5D%5Bvc60%5D%5Bill7!lh8,3!li14,3!la12,26,9!ll7%5D

damn chart wont transfer. put in the 50 and 200dsma

Russ u really love the sound of your own voice… Don’t you ??

Who gives a shit what Trades you’re doing !! BORING