Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets are posting solid across the board gains. Japan and South Korea are up 2%; Australia, China, Hong Kong, India and Taiwan are up 1% or more. Europe is currently mostly up. Austria, Belgium, Greece and the Czech Republic are up more than 1%. Futures here in the States point towards a positive open for the cash market.

The dollar is up. Oil and copper are down. Gold is up, silver down.

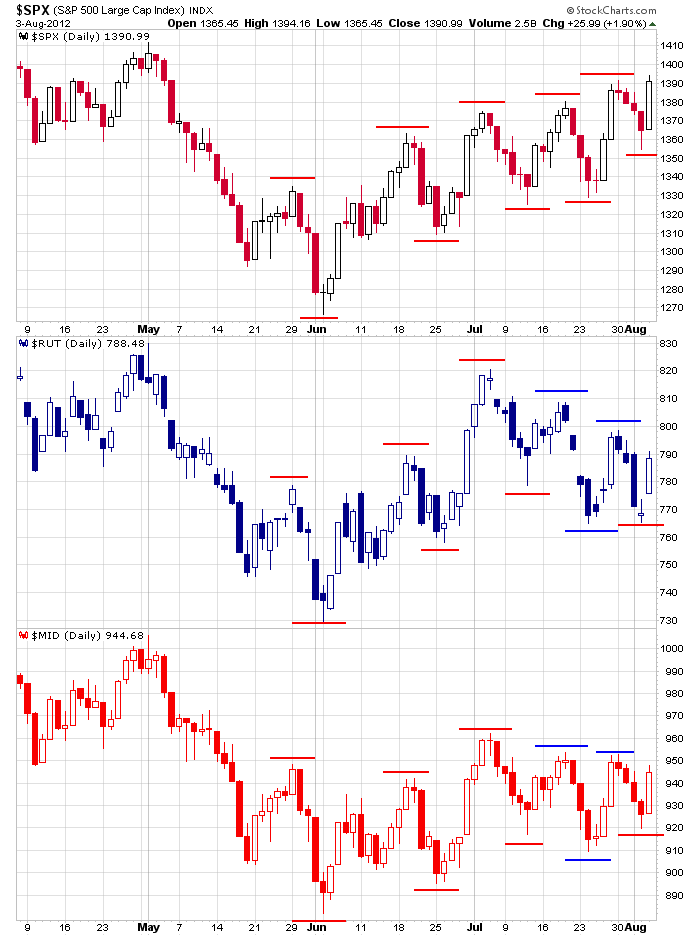

I don’t have anything to add to the comments I made over the weekend in the weekly report. Instead of 5 steps forward and 4 steps back, the last couple weeks have been several steps backward and then one or two giant steps forwards. The giant steps being so big, the net change is positive. This has been the case for the Dow and S&P and for the most part, the Nas. But the small caps have lagged. Instead of matching the large cap indexes with higher highs and higher lows, the small caps have made lower highs and lower lows. The divergence is very noticeable and cannot last much longer. Here’s a chart comparing the S&P large caps to the Russell small caps and S&P mid caps. Until this divergence gets negated, getting super excited about any move up is foolish.

Two-year bond yields in Spain and Italy dropped today on speculation the ECB would buy government debt.

I lean to the upside as the new weeks starts, but I’m going to stay somewhat conservative. That means just swinging for singles and being ahead of the curve taking profits. . Besides the divergence mentioned above, here’s briefly what’s on my mind…

Major market moving news items in the US are being checked off our lists. The Fed, employment numbers are both done. We still have earnings season to finish, but now we move into the August doldrums where volume will declined. We’ll see if activity does the same. More after the Open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 6)”

Leave a Reply

You must be logged in to post a comment.

http://stockcharts.com/h-sc/ui?s=$SOX&p=D&yr=1&mn=0&dy=0&id=p95262462501&a=44640932&listNum=2

http://stockcharts.com/h-sc/ui?c=$VXo,uu%5bw,a%5ddaclyiay%5bdd%5d%5bpb50!b200!f%5d%5bvc60%5d%5biLb5!Lh8,3%5d&pref=G

I have a new name for the market : horseshit

skank is speaking today and this is the feds way of showing the world

the marlet approves of what he’s saying. pure smoke and mirrors

the way you can tell it’s the fed is there is no up and down volitility,

which ws would do if it could. this is plain obvious prop up

i follow the ecb plunge protection team and james bond of mi5,the have taken over world domination as the fed is bankrupt

instos are selling to the corupt mi5

retailers also buying

for a insight into who is doing what to whom,read the book—none dare call it conspiracy

it can be googled and downloaded in pdf format

Description Due to deliver a speech titled “Economic Measurement” at the 32nd General Conference of the International Association for Research in Income and Wealth in Cambridge, via satellite;

Source Federal Reserve (latest release)

Speaker Federal Reserve Chairman Ben Bernanke;

Usual Effect More hawkish than expected = Good for currency;

FF Notes Fed Chairman Feb 2006 – Jan 2014. Fed Governor Feb 2002 – Jan 2020. As head of the central bank, which controls short term interest rates, he has more influence over the nation’s currency value than any other person. Traders scrutinize his public engagements as they are often used to drop subtle clues regarding future monetary policy;

last time he spoke on july 24th the market went up 5 days straight

his boss is sir timmothy goofy or is it goldmans,jpmorgans or morgan stanley ect

ndx 100 has filled its open gap at 2704–will it continue up–down or just chern