Good morning. Happy Tuesday.

The Asian/Pacific markets closed mostly up, but only India (up 1.1%) moved more than 1%. Europe is currently trading mixed and with a bullish bias. Greece is up 2%; France and Germany are also up. Futures here in the States point towards a positive open for the cash market.

The dollar is down. Oil and copper are up. Gold and silver are up.

Australia kept interest rates unchanged. The Aussie dollar reached a 4-1/2 month high.

A lack of news yesterday produced a lack of movement. It was a productive day that saw the market move up and the small caps and Nas lead, but volume was light and selling into the close was noticeable.

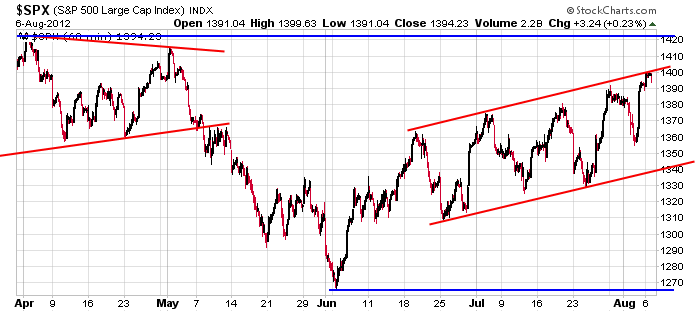

Depending on how you draw you trendlines, it could be argued the S&P is near resistance. The red trendlines in the following 60-min chart are parallel, and they capture all the movement from the last two months. “Containing” and “describing” the price movement increases the odds they are significant. I like the overall action, although the personality of the index (5 steps forward, 4 steps back, lots of sudden reversals, lots of gaps) has made swing trading challenging.

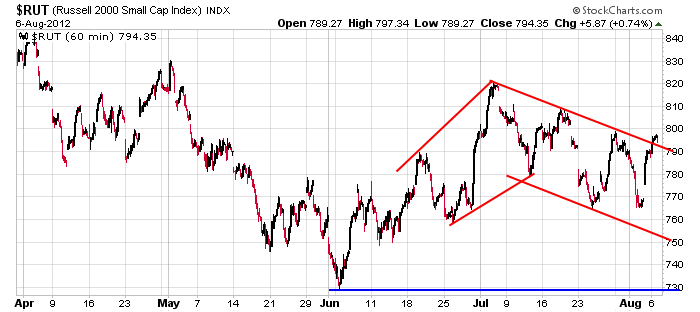

Here’s the equivalent Russell 2000 chart. It’s definitely a concern the small caps have been making lower highs and lower lows while the large caps have trended up. Last week $RUT made a higher low, and now it’s close to a higher high. It’s a needed step. This divergence needs to be negated if the market is going to sustain a rally. We need to see evidence traders/investors are willing to take on a little risk. A market that sees most of the money flowing into large cap safe havens will not stand. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers