Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Japan and South Korea rallied 0.9%. Europe is currently down across the board. Austria, Norway and Greece are down more than 1%. Futures here in the States point towards a down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

The Bank of England lowered its growth outlook. Otherwise there is no major news out of Europe…nothing about Greece, Spain or Italy.

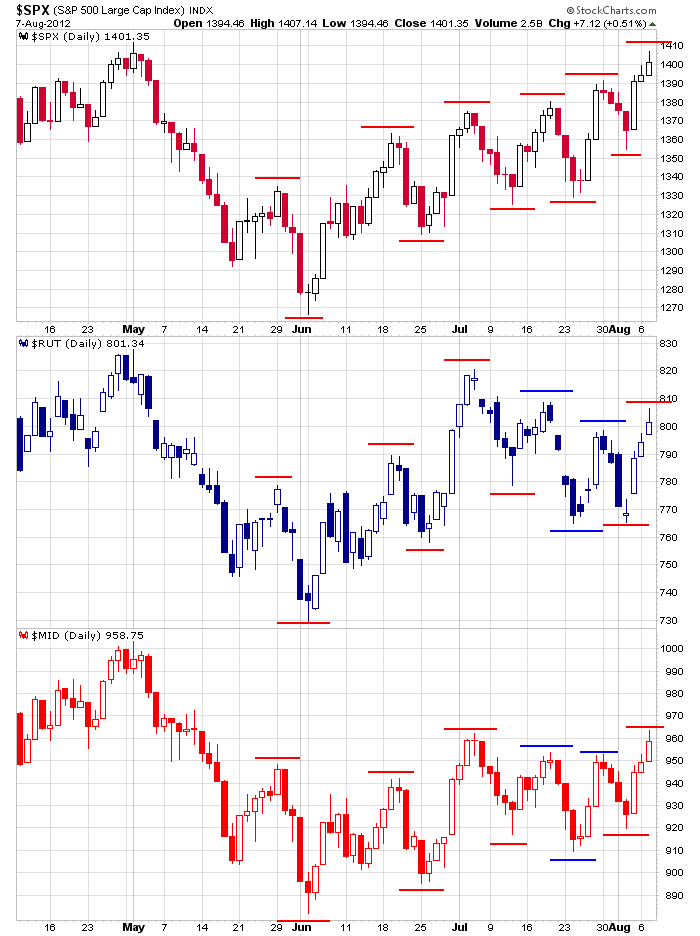

This is good. It enables us to focus on the US market which has made good progress recently. I’ve beening talking about the divergence between the large caps, small caps and mid caps for several weeks. Divergences can last in the near term but some simply cannot persist if the market is to move up. This is one of those. I need evidence investors are willing to take on a little risk by buying into small caps and mid caps rather than just putting their money in large cap safe havens. For several weeks, the large caps made higher highs and higher lows, but the small and mid caps were not able to match the movement, until now. Last week they made higher lows for the first time in three weeks, and yesterday they made a higher high. Overall the indexes are mostly neutral because they are little changed over the last couple months, but this recent development is a positive sign.

My bias of course is to the upside, but I am far from going all in. I’m still playing it safe. I’m still being conservative…especially after the recent move. For 2+ months the market has gone straight up or straight down, and the reversals have come out of nowhere and are often in the form of a gap. Take profits along the way. I’d rather miss some of a move than stick around too long. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 8)”

Leave a Reply

You must be logged in to post a comment.

Richard Fisher of the Dallas Fed is pointing out that no further Fed QE is required. Germany is not fighting bond buying via the ECB, but not EU bonds, measured inflation of the Euro instead. These things and the Congressional gridlock say a slight positive, but not the three day drive to the top. Why? What is the rush? Anticipation is NOT based on anything yet.

Caution is important until it is clear that there is some consensus in the markets. Right now exploitive buyers have pushed things up nicely, but there is nothing but air under the advance. It is an expectation advance, not earnings lead, or opportuntiy lead. Just hope of another free ride. TNX is rising, watch the bonds holdings.