Good morning. Happy Friday.

The Asian/Pacific markets closed mixed and with a slight bearish bias. Japan dropped 1%; nothing else moved 1%. Europe is currently mostly down. Greece is up almost 1%; France, Belgium, Germany and Stockholm are down. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

JCP posted a much bigger loss than expected. The stock is up in pre market trading. Ron Johnson, the CEO who came over from AAPL, has been a total disaster.

IBM is interested in buying RIM’s enterprise services unit.

US regulators have told five of the countries biggest banks (Bank of America, Goldmam Sachs, Citi, Morgan Stanley and JP Morgan) to develop plans for dealing with series financial problems, emphasizing the banks could not depend on the government for help.

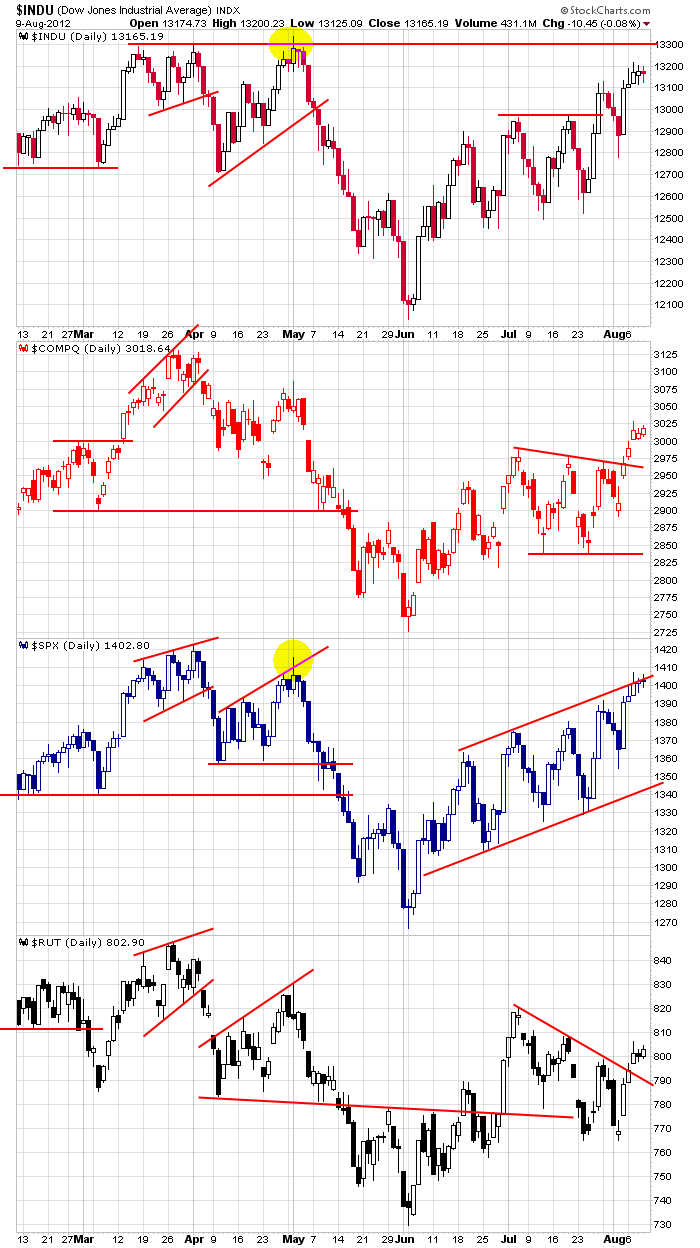

It’s been a pretty good week. The market rallied nicely Monday and Tuesday and then traded quietly and range bound Thursday and Friday. The Dow and S&P have been stair-stepping up for a couple months. The Nas recently broke out of a conoslidation range. The Russell is trying to reverse a series of lower highs and lower lows. As long as today isn’t a huge down day, another up week will be registered – the fifth consecutive for the S&P.

Many key groups have improved, and many stocks have improved even more. In fact we actually have some decent charts to play. But this is still a news dominated market. If left alone, the market would probably move up. But negative news out of Europe can come at any time, so we need to expect something bad to happen eventually.

Here are the daily index charts.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 10)”

Leave a Reply

You must be logged in to post a comment.

can anyone lend the ecb and fed some money so as we can have some more artificial bull

unless we have more liquidity teddy bear will eat all the bulls

is this a triangula flying spacecraft market as seen on t.v

or a bear market as seen by Jasons charts above

Hope this is the blow off Auzzie

Tim ,if we get to new highes then we will have a blow of finish to the world jaws of death broadening pattern,but that would come from Qe3 and europe increased liquidity in bonds/bank loans and more unsubstainable debt

so far there is no evidence of new highes–just hope and a lot of hot air and joint central bank prop ups of there respective plunge protection units

but looks like someone lent the ecb some money today as euro up almost 1 euro—once again helping the zombies forstall oblivion

my tick indicator last few days has been huging the nuetral line–plus small change in mccllenen ind plus small range inside days,with wide swings is suggesting a big move comming–up or down–next week

ftse- and german dax have closed at the same level last 3 days—its a mirical

TYVM – Auzzie