Good morning. Happy Monday. Hope you had a nice weekend.

The Asian/Pacific markets closed mixed with perpahs a bearish lean. China dropped 1.5% and Indonesia 0.9%. There were no bigger winners. Europe is currently mixed, but none of the indexes have moved much from their unchanged levels. Futures here in the States are flat.

The dollar is down. Oil is up, copper down. Gold is flat, silver down.

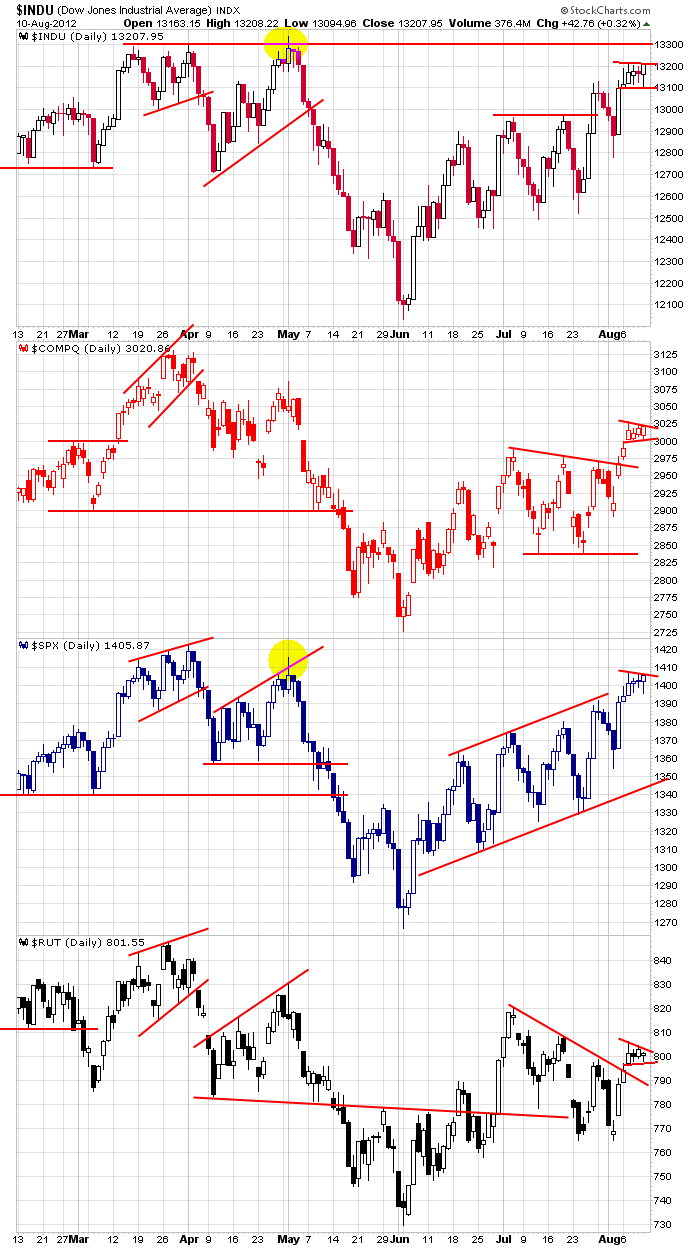

Last week was slow but productive. The market moved up big on Monday and then generally traded quietly the rest of the week. The Dow and S&P made higher highs, and the Nasdaq and Russell broke out from ranges. All the indexes are now trading in little flag/pennant patterns which have bullish implications. Here are the daily charts.

Google is laying off ~ 4,000 employees from Motorola Mobility…approx 2/3 will come from outside the US.

Bank of America is selling its Merrill Lynch international wealth management business to Julius Baer for $800 million cash.

Barnes & Noble is cutting the price of its 16-gigabyte Nook by 20%.

From a technical standpoint, the market is doing just fine. But this is August – the slowest month of the year – and news from Europe still has the ability to quickly move the market in either direction. I favor the upside, but I’m not going all in. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 13)”

Leave a Reply

You must be logged in to post a comment.

using Jasons analysis

flat is the name of the game and i suspect opts ex to be involved

yes there are little flag penuts formations but also could be considered as trading against the spike-last monday was the spike up day and usually if it has not broken out of the spike within 4 days it will reverse–therefore we have last mondays move to go above if up

last weeks small move in the mcclellan indicator and my tick ind flat are saying there is a big move coming soon

today has been testing the downside with some negative tick extremes ind insto selling

the ftse/dax broke fri lows but recovered slightly,but importantly with higher euro divergence

indicating that even with central bank intervention to hold the euro up ,that it couldnt hold the london ftse or german dax up

conclusion —i have no darn idea where the markets going to go ,but im happy just trading some nice intraday moves to the down and up side, using my present time /futureistic indicators,with no mr hindsight indicators to worry about

how deep are central banks pockets to hold this market up–especially with instos selling and /or not buying

Thanks for your TA Auzzie – looking weak on the Tick – E mini – and bonds holding up = Max Pain for OPEX – SPY = 137 ??