Options expire this Friday, so let’s take a look at the open-interest on SPY, DIA, QQQ and IWM to see if they hint at movement the rest of the week. Here’s the theory: the market conspires to cause the most pain, to cause the most number of people to lose the most amount of money. If the market is to accomplish this, what does it need to do this week?

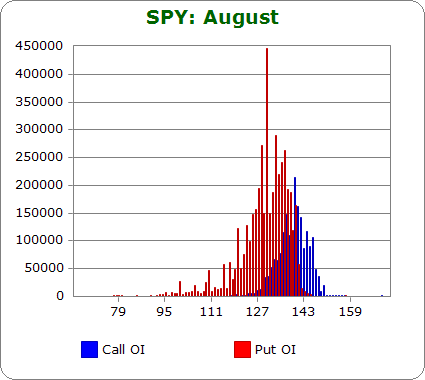

SPY (closed 140.79)

Puts out-number calls 2.2-to-1.0 – about the same as last month.

Call OI is highest between 136 and 146.

Put OI is highest between 120 and 140.

There’s overlap between 136 and 140, and since puts more than double up calls, a close in the upper half of this range is needed to inflict max pain. Today’s close was at 140.79 – that’s a just above the top of the range, a level that will cause most puts to expire worthless Friday. Flat trading would be find, but a slight move down would be better..

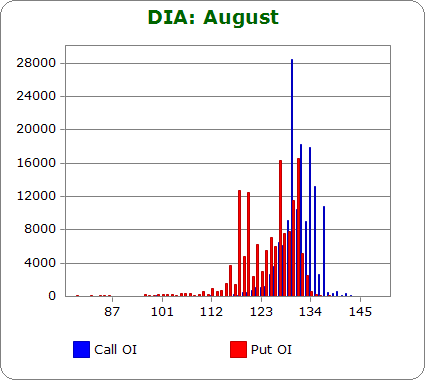

DIA (closed 131.66)

Puts out-number calls 1.1-to-1.0 – less bearish than last month.

Call OI is between 129 and 137.

Put OI is more sporadic. The highest OI appear at the following strikes: 118, 120, 127, 130, 131.

For what it’s worth (because volume is so light), there’s overlap between 129 and 131 with the biggest spikes appearing at 130 and 131. A close right there would cause the most pain, or at least cause a lot of pain. Today’s close was at 131.66 – slightly above the range. I would not want to see a move up becasue then all those calls at 130 would make money. Slightly down movement is needed.

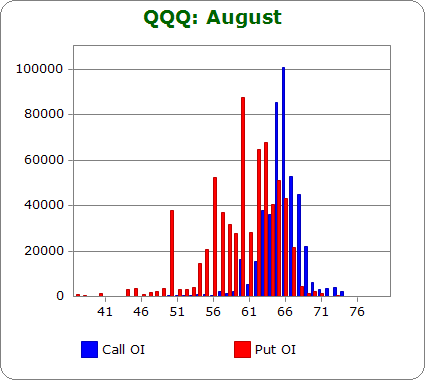

QQQ (closed 67.05)

Puts out-number calls 1.8-to-1.0 – less bearish than last month.

Call OI is highest at 65 and 66, and two strikes above and below (63, 64 and 67, 68) have high OI but not nearly as high as the two spikes.

Put OI is highest – not consistently – between 56 and 66.

There’s overlap between 63 and 66. Today’s close was at 67.05, which is above the range. That’s ok, but I wouldn’t want to see the stock move up from here. Otherwise buyers of the 65 and 66 calls will start making money. Flat or down movement is needed.

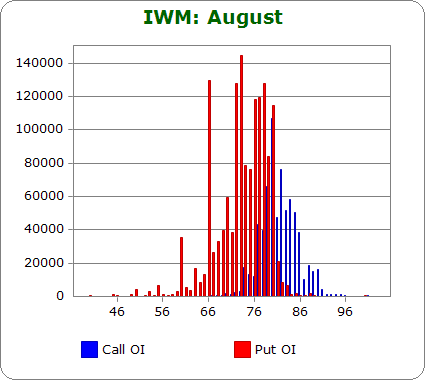

IWM (closed 79.60)

Puts out-number calls 2.2-to-1.0 – slightly less bearish than last month.

Call OI is highest between 79 and 82, and there’s a big spike at 80.

Put OI is highest between 72 and 80, and there’s a spike down at 66.

There’s overlap in the 79/80 area, and the one big call spike happens to be at the top of the put OI range. IWM closed at 79.60 today. That’s perfect. Flat trading is needed the rest of the week to achieve max pain among IWM option buyers.

Overall Conclusion: The numbers discussed above tell me the market is already priced to inflict a lot of pain on option buyers, but a slight move down would cause even more pain.

Have a great night.

Jason Leavitt