Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. China and Hong Kong dropped more than 1%; South Korea rallied more than 1%. Europe is currently mixed. None of the indexes have moved more than 1% from their unchanged levels. Futures here in the States point towards down open for the cash market.

The dollar is up. Oil and copper are down. Gold and silver are down.

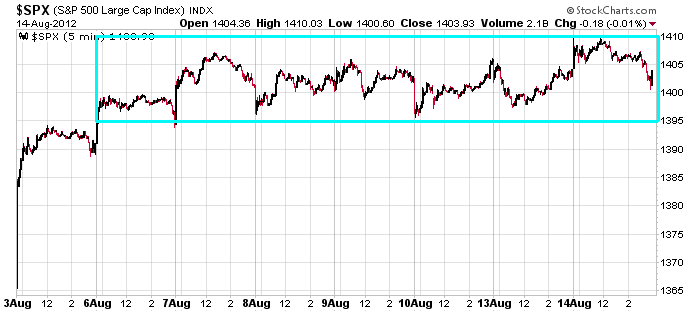

Yesterday the S&P moved above its consolidation range, but it couldn’t get any traction. Then afternoon selling closed the index back in the range. Here’s the 5-min chart…a 15-point range covers the last seven days.

Yes the market has been slow. Tis the season. Volume has been light and catalysts have been few and far between. You can be pissed off at the lack of movement or just accept what you can’t control. Rest up, read a book. Make sure you’re ready for the fall season.

CSCO is out with earnings…the stock is up a few cents in pre market trading.

TGT is out too…the stock is up 1%.

SPLS is down 16%

DE is down 5%.

Don’t over analyze and don’t force trades. Conserve capital. China hasn’t gone away. Europe hasn’t fixed itself. The election in the US will pick up. The market movement will pick back up soon. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 15)”

Leave a Reply

You must be logged in to post a comment.

Appears that nothing is happening, but that might be in error. The EU may change its stance on bonds and sell some soon, but probably not nearly enough to get the job done. It is the sore spot until after the US elections. China is slowing, but how much is the issue. I am long CHN based on the composition of the etf and the CBC known capacity to move things when it wants them moved. That leaves the US. No idea, so cash and IVOO as a sea anchor. Oh yes, lots of munis for a while longer – at least until TYX moves up to 300 bp. It is down this opening. The bet is the FED does nothing but jaw bone. Cheers

intraday we are getting some good moves

the range may be small ,but the moves are good and fast

the ecb is busted -broke and cant issue new bonds unless germany pays

or the imf helps out

the fed is busted and cant do QE3 unless tiny tim authorises

and with politican ron paul out to have the fed removed –i doubt obarma would dare authorize

buy your remimbie chiness yaun now ,via a hsbc bank remimbi savings a/c whilst the usd is strong and average up

stop talking and get back to work

Thanks for your thoughts, Auzzie and Whibley – appreciated –

pay your tax to line polititians and bankers pockets.

work like a slave eat your slop and stop complaining