Good morning. Happy Thursday.

The Asian/Pacific markets closed mixed. Australia and New Zealand rallied better than 1%. Europe is currently mixed. There are no 1% movers. Futures here in the States point towards a positive open for the cash market.

The dollar is up a small amount. Oil is up a little; copper is flat. Gold and silver are mostly flat.

CSCO did well with earnings. They raised their dividend, and the stock is up 7.4% pre market – a huge move for the company.

WMT beat estimates by a penny. The stock is down $1.73 before the open.

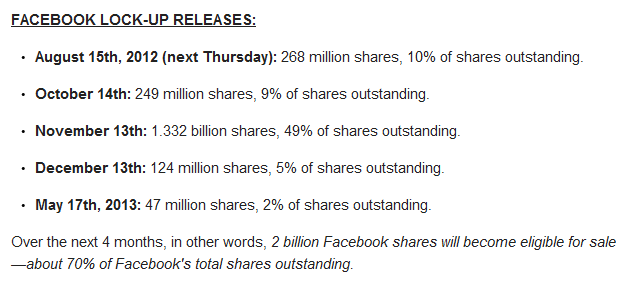

One of Facebook’s lock ups ends today. 268 million shares, or about 10% of outstanding shares, are now available to be sold. This is big but not nearly as big as their mid November lock up expiration. According to Business Insider, these are the dates…

I’m thinking a time to buy FB may be right around that November lock up. Some selling pressure ahead of the date along with a little downside pressure after may provide a good buying opportunity. I’ve seen it happen many times. Everyone thinks a stock is going to tank, and instead it takes off.

AAPL is supposedly in talks with cable companies about Apple TV (not an actual TV, the set-top boxes). TV is the last frontier. It’s one piece of technology that hasn’t changed in decades.

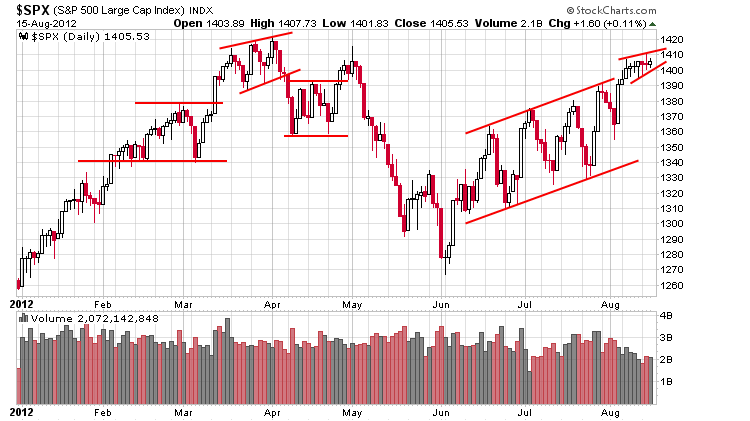

The market has been very slow lately, but some discrepancies are starting to form between the indexes. Here’s the daily S&P. Yesterday it hit a higher high, but a small rising wedge is forming. Be careful out there. You definitely don’t want to put all your chips on the table. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 16)”

Leave a Reply

You must be logged in to post a comment.

The VIX readings suggest market near a top. Usually followed by a correct>6% lasting two months more or less.

The wedge shown in Jason’s graphs are suggestive of the top. Link of history of VIX.

http://1.bp.blogspot.com/-hWRDMPDpmOs/UCxbfJL9tQI/AAAAAAAABSw/Gw51Pbn5LpI/s400/vix.png

Thanks Whidbey

yes thanks whid great job figuring out the market should come down

please let us know when you figure out why it’s not

it was the hash of nite for some or high noon for others

not a bullish fed was moving

just some greedy insto bank market makers so easyly moving the market,probably on no volume moving the market to the opts ex strike price for tomorrows opts ex

the bull muster may be coming to a close–and the abbotours glue factory next

shares are just pawns to their derivitive masters

dont trade prawns trade galactic futures

too many puts put a floor under the market and make skanks job easy

opt traders crap in their own beds

3rd day in a row buying aci morning dip and selling afternoon

maybe some shorts could roll ole greenspan out in a wheelchair

and he could shake his fist and yell IRRATIONAL EXHUBERANCE !!

can naked shorts being called up cause a irrational exhuberance false break top

commonly called a blow off top

QE3 before the bell friday—-LOL

disappointing leading indicators would be a perfect excuse…

no matter what the numbers are

you can tell we’re close to a top

cnbc’s trotting out the goofy looking fukers

claiming we’re going up 20% from here

im short for a bit of fun ,but prob a flat day