Good morning. Happy Wednesday.

The Asian/Pacific markets closed mixed. Indonesia, China and India suffered noticeable drops. Europe is currently mixed; Greece is down 1.5%, otherwise there are no 1% movers. Futures here in the States point towards a flat open for the cash market.

The dollar is up slightly. Oil and copper are down. Gold and silver are down.

There’s no earth-shattering news to talk about. The market is slow. The ranges are small. The volumes are light. There are some decent set ups to be played, but for the most part we aren’t getting follow through. Quick trades are the name of the game. We need to be content with small profits right now…if you choose to trade at all.

Bernanke speaks tomorrow. Some are hyping it up as an important speech; others say it’s very over-rated. The market has done well since the June low. Perhaps QE3 is being priced in, and if Wall St. doesn’t get it, it’ll be a big let down. But we could also get a “sell the news” scenario which would lead to selling anyways. After all, each round of easing has had diminishing returns, and the S&P is 150 points off its low. How much further can the rally go, especially considering key foreign markets are not keeping up?

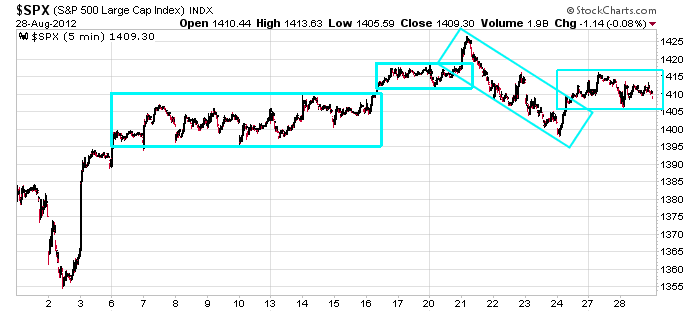

Here the 5-min S&P chart over the last month…from one range to the next. We’ve gotten almost no directional moves…just lots of grinding in place.

Don’t force it out there. Be conservative. Rest up, read a book, get ready for the fall season. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Aug 29)”

Leave a Reply

You must be logged in to post a comment.

romney and the boys want the market down this week to show the country

how bad bama mama sucks.

skankie not letting it come down is a big middle finger in their face.

romney said if he wins, he will fire skankie

skankie said f u

http://www.federalreserve.gov/whatsnext.htm

According to the above website, Ben does not speak until Friday. Not tomorrow.

August 31 Speech–Chairman Ben S. Bernanke

Monetary Policy Since the Crisis

At the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming

10 a.m. EDT

But what do I know…

Kezha

nothing

you think someone can only say something during a future speech

look at the market genius

the fed was started in early 1900’s by the big bank instos to syphone money out of taxpayers govts and the fed is owned by wall street and fleet street as a independant body

politicans are trained and owned by wall street and are not ellected by the public

look at the bush family connections with the rockerfella foundation

wall st and all world politicans are owned by a corupt evil illuminate mafia that run the world–they are a handfull of evil pschycopathic criminals that run the world

the next usa president may very well be a marsian allien orriginally from the orion galacy

—a mormon

wall street via the markets will tell us who wins

lol very good taz. and to think for a moment I wondered if

anyone at this blog could be taught anything

been some nice and very tradable intra day range trade moves

small range large margin bets ideal for intraday scalpers and easy to read

took me all day to get 3% on aci

skank has taught bama how to bark and get oil down

threaten em with reserve release

same way he mentions qe3 and gets a market pop

good trick

all markets on the weekly charts wedging out

all they’re waiting for is bulls to get the bad news, won’t be long now

the great walrus vows to throw 40 bil a month on the bonfire. this should remove all doubt about fed intervention