Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly down. Australia, Hong Kong, Indonesia, Japan, Singapore and South Korea each dropped about 1% or more. Europe is currently down across the board. Futures here in the States point towards a moderate gap down open for the cash market.

The dollar is down slightly. Oil is down, copper is down. Gold and silver are flat.

Brazil’s central bank cut its benchmarket interest rate to 7.5% – an all-time low. Sheesh, they don’t know what low rates are.

A Chinese premier said China is prepared to purchase more European debt.

German unemployment climbed for the fifth straight month.

Most company-specific news this morning comes from small companies that trade very little volume and aren’t interesting to us.

However…

LYB is being added to the S&P 500 after the close on Sept 4. SHLD is being removed.

Pandora (P) is up 15% – earnings related.

TIVO (TIVO) reported a loss, but the loss was less than expected.

I’ve been under the impression Bernanke spoke today at Jackson Hole, but the Fed’s website says he speaks at 10am EST on Friday.

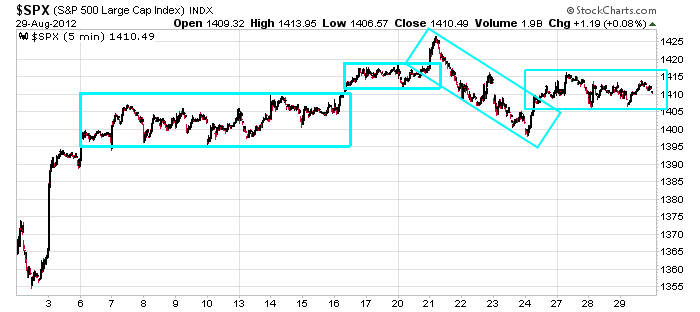

The market of course has been very slow lately. The ranges have been small, the volume light. Traders are getting anxious. Pressure is building, so it wouldn’t take much for either the bulls or bears to take over and push prices hard in one direction. Here’s the 5-min S&P chart. I gotta think some pressure will be released soon. Perhaps tomorrow while Bernanke speaks, but what kind of legs might a move get? We have a 3-day holiday weekend ahead of us. I remain in conservative capital preservation mode.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers