Good morning. Happy Thursday.

The Asian/Pacific markets closed mostly up. Malaysia dropped 1.4%; Australia, China and Indonesia rallied 0.7% or more. Europe is currently mostly up. France, Germany and Austria are up more than 1%. Futures here in the States point towards a moderate gap up open for the cash market.

The dollar is down. Oil is up, copper down. Gold and silver are down.

Today’s big news comes at 8:30 EST when the ECB holds a press conference. The market expects the ECB to announce a bond purchase program, which would boost bond prices and drive yields down. Several EU countries are in very bad shape…having to 7+ percent interest on short term debt is death.

The ADP jobs report, which was expected to be +140K, came in at +201K – a big beat.

First time jobless claims dropped 12K (1K was expected).

AMZN is developing a smart phone – another player in the mix.

In pre market trading, MW is up 9% and NAV is up 13% – both earnings related.

OCZ is down 20%, PAY is down 13% – due to earnings.

The first two days of this week have been a continuation of August’s slow action, but this should change soon. Besides the market being very wound up (from a technical standpoint), some major news items will be released soon. Between the ECB press conference and tomorrow’s unemployment report, one by one, excuses are being removed. Traders who have been waiting for the “all clear” sign are in the process of getting it.

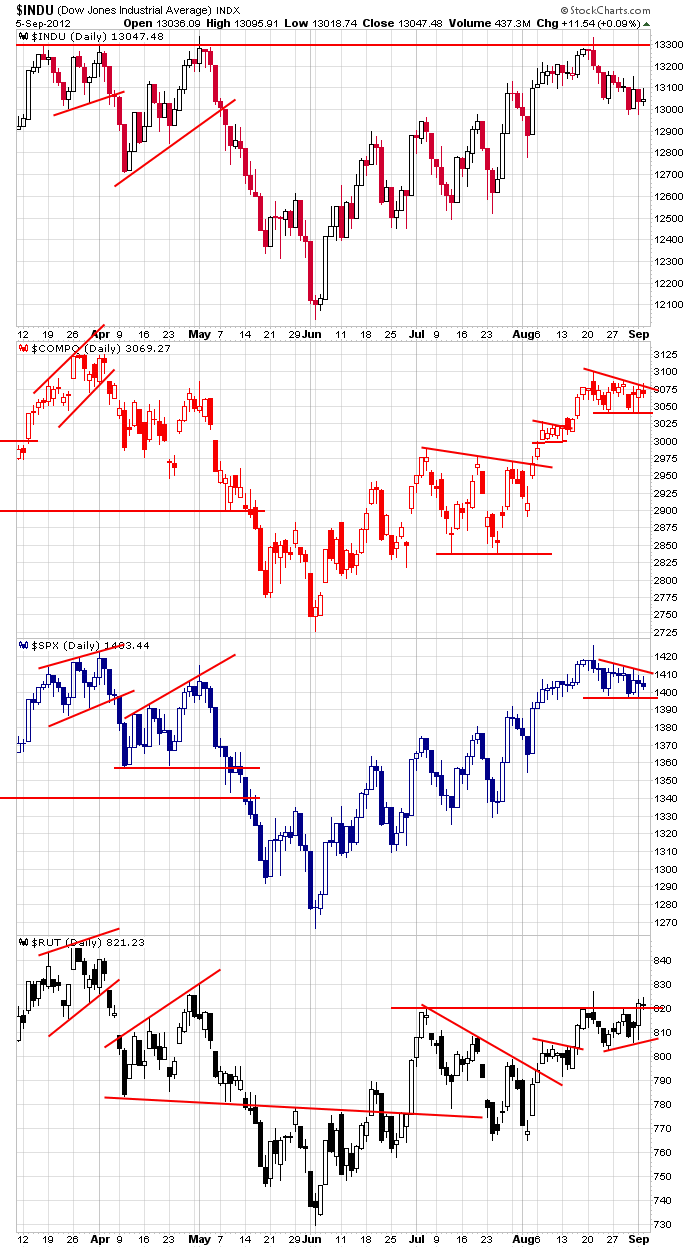

Here’s an update of the daily charts. The Dow has made higher highs and higher lows since early June, and although short term support and resistance are not clearly defined, there’s nothing overly wrong with the action. The Nas and S&P are setting up nicely in consolidation patterns with uptrends. The Russell broke out two days ago but could not follow through yesterday. The small caps needed to do well for a rally to materialize.

Soon, very soon, the market will wake up. I hope you’re ready. We’ve had enough slow action for you to rest up and recharge. The fall should be an active time. More after the open.

headlines at Yahoo Finance

headlines at MarketWatch

today’s upgrades/downgrades

this week’s Earnings

this week’s Economic Numbers

0 thoughts on “Before the Open (Sep 6)”

Leave a Reply

You must be logged in to post a comment.

Today you owe 17,143 dollars in national debt, and it will take 36 years to pay at the rate contemplated; (they will be adding). As for the employment numbers, we hope they are accurate, but it is the beginning of the economic season and we need another month to know even after Friday. The average required is 250K month, which is questionable for a number of reasons.

The markets look eager to go, maybe up big this quarter if given any hope, but they are volatile and skittish, but maybe under priced historically. Who knows. I say be partly invested and watch. Who is Draghi that he can raise all this money, spend it and then claim to have it all sterlized so inflation is just not an issue?? We need one of those.

not logical to hold long here intraday after such a big spike up day at piviot extremes,tick divergence weakness

rolling over now –just waiting on ndx to finish

was this the one day wonder–spike high or do we go higher tomorrow–well i will consider that tomorrow

This video is getting a lot of buzz – on the printing and trillions of debt

Full Interview With Billionaire Frank Giustra – minning billionare

http://www.youtube.com/watch?v=9o30gNfPq_k&feature=player_embedded